I hope you can join me, David Campbell, as I present powerful information on a panel with America’s premier minds in commercial real estate at

The Ultimate Commercial Loan Workout Symposium.

Wednesday, July 06, 2011

from 8:30 AM – 5:30 PM (PT)

Los Angeles, CA – Four Seasons Hotel

Featuring ten nationally renowned experts including Master Real Estate Investing Strategist and Founder of Hassle-free Cashflow Investing Mr. David Campbell.

Secrets to a Successful Distressed Commercial Loan Workout…Even if Your Property Is “Underwater”

***7 hours of CE credits for California CPAs***

***3 hours of MCLE credit for California lawyers

(application pending)***

FOR MORE INFORMATION or to register for The Ultimate Commercial Loan Workout Symposium CLICK HERE.

Special offer for friends of Hassle-free Cashflow Investing:

30% off registration! Use discount code: Campbell

SAVE YOUR COMMERCIAL PROPERTY FROM FORECLOSURE

UNDER THE NEW RULES FOR COMMERCIAL LOAN WORKOUT

Owners and developers of financially troubled real estate projects must keep properties afloat despite waning cash flows and weakening property values. You have millions already invested in your project. If you have investors, the burden of your responsibility to protect their hard-earned savings weighs heavy on your shoulders. The decisions you make at this crucial time not only impact this investment but perhaps your entire financial future. Walk into this event with your problem loan–walk out with a stack of new ideas, strategies, contacts, and potential solutions that you can act on immediately in your commercial loan workout.

Who should attend:

Commercial real estate investors

Commercial real estate advisers, including:

CPAs

Commercial real estate brokers

Commercial mortgage brokers

Commercial real estate asset managers

Commercial property managers

Real estate lawyers

Includes networking lunch at the fabulous Four Seasons Hotel.

Why you need The Ultimate Commercial Loan Workout Symposium and why you need it NOW:

At the risk of invoking the over-used “perfect storm” analogy, that is exactly what the already distressed commercial loan borrower is facing.

Consider this:

§ Effective June 15, 2011, new FASB accounting standards change the way lenders are required to report their troubled debt restructurings. This significant development introduces yet more uncertainty for the commercial borrower in distress.

§ The near-term outlook for commercial loans is dismal. A recent United States Congressional Oversight Panel report expressed “deep[] concern…that commercial loan losses could jeopardize the stability of many banks…and…contribute to prolonged weakness throughout the economy.

§ Between now and 2014, about $1.4 trillion in commercial real estate loans will reach the end of their terms. Nearly half are at present ”underwater”.

§ Commercial property values have fallen more than 40 percent since the beginning of 2007.

§ The largest commercial real estate loan losses are projected for 2011 and beyond; losses at banks alone could range as high as $200-$300 billion.

§ Difficulties in getting new loans creates uncertainty for commercial borrowers who need to refinance because their loans are now coming due.

§ Many commercial property owners are confronting severe financial challenges due to the lingering recession.

This convergence of risks and challenges makes it crucial that the commercial borrower approach the commercial loan workout negotiation more strategically and better equipped than ever before.

With the right commercial loan workout strategy, you could get your lender to agree to:

Lower your monthly payments

Reduce your interest rate

Stop receivership

Delay the foreclosure process

Stop the foreclosure process

Convert to interest only

Lengthen your amortization schedule

Reduce or eliminate late fees /penalties

Extend your loan maturity date

Even advance you more money to save your property

But you need to know how to play the game.

What you learn here could make the difference between success and failure in your commercial loan workout negotiation

Join our distinguished panel as they guide you through the landmines and give you an easy-to-understand step-by-step action plan to maximize your chances for success in your commercial loan workout.

Here’s just a partial list of what you will learn:

1. The 7-step process to virtually every successful commercial loan workout

2. Ten questions you must answer before beginning any loan workout negotiation…any one of the answers could radically impact your leverage in the negotiation

3. Special commercial loan workout issues presented by securitized loans

4. Special commercial loan workout issues presented by construction loans

5. What is a BOV, when and why you need one, and how to get it without charge

6. What works and what doesn’t: An “insiders” look at the lender’s playbook for distressed loan negotiations–this will help you almost read your lender’s mind and push the right buttons at the right time to improve your outcome

7. The impact of having multiple lenders in a commercial loan workout

8. The impact of having multiple borrowers in a commercial loan workout

9. Four proven strategies to stop a foreclosure sale dead in its tracks

10. The danger of waiting too long to attack a sale…why seeking to prevent a trustee sale is always better than trying to set one aside after the fact.

11. Four legal grounds to recover your money damages PLUS your attorney’s fees PLUS your lost profits PLUS punitive damages from the lender after a wrongful foreclosure and sale

12. Six ways you can turn the tables on the lender with legal claims of lender liability

13. The trap for the unwary borrower that could defeat any breach of contract action against the lender

14. Six different ways your lender might have breached your loan documents that could radically improve your bargaining position in your loan workout negotiation

15. How to hold the lender accountable for its broken ORAL promise to extend your trustee sale date

16. Five different varieties of fraud–any one of which could be enough to win your case.

17. The duress defense

18. The elder abuse remedy

19. The difference between a “restructure” and a “workout” and why you must know which term applies to your situation.

20. The critical first step that will stack the odds in your favor for a successful negotiation

21. What is a “loss share agreement” and why you must know if your lender has one

22. “Pre-workout Letters”: which term every investor should push back on

23. What is a “clawback” and why you need to know about it

24. What is “springing recourse” and “springing lockbox”

25. When a non-recourse loan isn’t–how investors could unexpectedly lose this crucial form of asset protection if they’re not careful

26. Alternatives to foreclosure

27. The right and wrong way to play “the bankruptcy card”

28. What is a “cram down” and how you can use it to turn the tables on the lender

29. Four questions that could determine whether a lender will work with you or dump you

30. Five powerful, proven arguments you can make to convince a lender to keep you in control of your project

31. Deed in lieu of foreclosure

32. Consensual foreclosure

33. How to still make $$ from your project even if you give it back to the lender

34. The commercial short sale process

35. Forbearance Agreements

36. Twelve powerful, proven bargaining chips to help convince a lender to work with you

37. The “Hail Mary” workout strategy that actually works

38. The tax and accounting issues you must understand before you commit to any workout

39. Asset protection strategies: what you can and can’t do when your loan is in distress.

40. What every investor must understand about fraudulent transfers to avoid criminal and civil penalties.

41. How can borrowers identify and minimize their legal risks when contemplating a real estate workout?

42. What are some best practices in negotiating a real estate workout agreement?

…and much, much more!

FOR MORE INFORMATION or to register for The Ultimate Commercial Loan Workout Symposium CLICK HERE.

Special offer for friends of Hassle-free Cashflow Investing:

30% off registration! Use discount code: Campbell

6 REASONS WHY YOU CAN’T AFFORD TO MISS THIS COMMERCIAL LOAN WORKOUT EVENT:

1. The Rules Of The Game Have Changed

You are facing a perfect storm of challenges and the new FASB standards are just one reason why the rules of the game for commercial loan modifications are different. Attend this special event and you will learn how to use those rules to your maximum advantage instead of being blindsided by your ignorance of the new reality.

2. This Information Isn’t Available At Any Other Seminar

We are not aware of anywhere that you can get all this critical information from such reputable sources. If you’re looking for the fastest and least expensive way to access this information from these sources, this Symposium is it.

3. The Least Expensive Way To Get All This Expertise

If you were going to buy the time of each of these professionals, it would cost you thousands of dollars. Your nominal investment in this Symposium is a fraction of that cost.

4. Cutting-Edge, Creative Solutions To Your Problems

Attend this Symposium and learn the latest, cutting-edge strategies, one or more of which could be the one that saves your investment in your property and your financial future.

5. Incredible Networking Opportunity

At almost every live event, the best part is usually the connection you make with somebody who may be able to help you solve your problems and take your business to the next level.

6. You Have Zero Risk: Our 100% Satisfaction Guarantee

We are offering this program with our Zero-Risk 30-Day 100% Satisfaction Or Your Money Back Guarantee. Simply attend the event, then take a full 30 days to try out the strategies, techniques and distinctions you’ll learn. If you don’t agree this event was worth every penny, just contact us and we’ll refund 100% of your money, no questions asked. This does not constitute a guarantee, warranty, or prediction regarding your results but, rather, only that you will be satisfied with the educational content of this event.

Commercial Loan Workout Symposium SPECIAL BONUS #1:

Early-Registration Discount

If you purchase by June 27, 2011 you will receive $100 OFF the regular price!

Commercial Loan Workout Symposium SPECIAL BONUS #2:

30-Minute Legal Consultation

You’ll get 30 minutes with Jeff Lerman, “The Real Estate Investor’s Lawyer” to discuss your commercial loan workout and potential legal “ammunition” you may be able to use in your workout negotiation

Commercial Loan Workout Symposium SPECIAL BONUS #3:

30-Minute Bankruptcy Strategy Session

You’ll get 30 minutes with Lou Kempinsky to discuss your bankruptcy strategy and questions

Commercial Loan Workout Symposium SPECIAL BONUS #4:

Commercial Loan Workout Feasibility Analysis

You’ll get a preliminary loan workout feasibility analysis by Guardian Solutions.

Commercial Loan Workout Symposium SPECIAL BONUS #5:

Strategic Brainstorming Session For Your Loan

You’ll get a complimentary brainstorming session to discuss your problem loan and potential solutions with master real estate investment strategist David Campbell

Commercial Loan Workout Symposium SPECIAL BONUS #6:

Recording of Entire Event

Register for the live event and you’ll also get a recording of the entire event (after refund period expires).

Commercial Loan Workout Symposium SPECIAL BONUS #7:

10% Discount Off Legal Services

You’ll get a 10% discount of legal services at Lerman Law Partners, LLP, up to the cost of your registration.

WARNING: SPACE IS LIMITED, SO RESERVE QUICKLY!

FOR MORE INFORMATION or to register for The Ultimate Commercial Loan Workout Symposium CLICK HERE.

Special offer for friends of Hassle-free Cashflow Investing:

30% off registration! Use discount code: Campbell

Meet the Faculty for The Ultimate Commercial Loan Workout Symposium

David Campbell,

David Campbell,

Real Estate Investment Strategist

A real estate developer, investor, syndicator, and broker, Mr. Campbell has been a principal or key advisor in over $800 million of real estate transactions including apartments, office, retail, hospitality, winery, condo-conversion, and production home building. Believing that properties do not have problems, people do, David takes a people first approach towards finding creative solutions for difficult properties and the people who own them. Mr. Campbell’s ebooks, “Hassle-free Cashflow Investing” and “Hassle-free Cashflow Lending,” and his popular real estate investing blog can be found at www.HasslefreeCashflowInvesting.com.

Jeffrey H. Lerman, Esq.,

Jeffrey H. Lerman, Esq.,

Managing Partner, Lerman Law Partners, LLP

Mr. Lerman’s past positions include President of the County Bar Association, Co-Chair of the California State Bar Real Estate Litigation Section, and Co-Chair of the County Bar Real Property Section. He has developed a nationwide reputation as “The Real Estate Investor’s Lawyer”, having been featured as guest commentator on TV, radio and in newspapers. His practice focuses on helping commercial real estate investors, including loan workouts. He has been awarded the highest rating possible for professional excellence, legal ability and ethical standards by his peers (Rated “AV-Preeminent” by Martindale-Hubbell). His law firm website is www.RealEstateInvestorLaw.com.

Michelle C. Lerman,

Michelle C. Lerman,

Partner, Lerman Law Partners, LLP

A Certified Specialist in Estate Planning, Trust & Probate Law by the California Board of Legal Specialization of the State Bar of California, Michelle has been in practice for more than 25 years, is the co-chair of the County Bar Association Mentor Group, member of the Estate Planning Council, JCEF Estate Planning Subcommittee and member of the Marin County Bar Association Board of Directors.

Louis E. Kempinsky, Esq.,

Louis E. Kempinsky, Esq.,

Peitzman, Weg & Kempinsky LLP

Mr. Kempinsky’s practice encompasses trial and appellate work in both State and Federal courts, involving a wide variety of issues, including bankruptcy, business torts, commercial, contract, corporate governance, environmental, franchise, real estate, trademark and other intellectual property. Mr. Kempinsky also represents creditors and debtors in bankruptcy cases and out of court workouts. He also sits as a judge pro tempore and lectures frequently. He has been honored by the American Bar Association and has been named a “Super Lawyer” by Law & Politics and Los Angeles Magazine.

Steven Fried,

Steven Fried,

Capital Finance

After 11 years with major banks, in 1979, Mr. Fried entered the field of Independent Banking, rehabilitating troubled banks. He has been the Chief Executive Officer of three different banks, testified before the Securities and Exchange Commission and as an expert witness on matters related to finance. In 1992 he was named President of the California Independent Bankers. Mr. Fried is the owner of Capital Finance, a finance and consulting concern, providing expert testimony, litigation support and consulting services to the legal community. Capital Finance is a licensed & bonded Commercial Finance Lender.

Brian Shniderson,

Brian Shniderson,

Managing Director,

B&A Capital Partners

Brian has been involved in real estate as an investor, developer, lender and workout consultant for the past 20 years. Brian is the Managing Director of B&A Capital Partners. B&A is a direct Lender on commercial real estate transactions ranging in size from $2MM – $30MM, nationwide and in Canada for short term, private money, bridge loans.

Steve Bram,

Steve Bram,

Co-Founder,

George Smith Partners

Mr. Bram is a co-Founder of George Smith Partners and served as the company President for over 5 years. He is widely recognized as one of the nation’s leading real estate investment banking professionals. During his more than two-decade tenure at the firm, he has arranged billions of dollars in financing. He is a specialist in the area of structured financing, and is recognized nationally for his expertise in the hotel and hospitality sector. Mr. Bram holds an MBA from The Wharton School of Finance. He earned his BS from the Cornell University School of Hotel Administration, graduating #1 in his class.

Kirk Malmrose,

Kirk Malmrose,

Managing Director,

TriSail Capital Corporation

Kirk Malmrose is a Managing Director for TriSail Capital Corporation, a wholly-owned subsidiary of Bank of America Merrill Lynch. TriSail provides high-leverage finance for real estate investments. During his tenure at TriSail, Mr. Malmrose has been directly involved in the underwriting, asset management and origination of over $350 Million in equity and mezzanine investments representing over $1 Billion in aggregate value. Mr. Malmrose has over 20 years experience in loan originations, workout, OREO, and corporate real estate.

Steven J. Oshins,

Steven J. Oshins,

Law Offices of Oshins & Associates, LLC

Based out of Las Vegas, Nevada, Steven is rated AV by the Martindale-Hubbell Law Directory and is listed in The Best Lawyers in America®. He was voted into the NAEPC Estate Planning Hall of Fame® and will be inducted in 2011. He has been named one of the Top 100 Attorneys in Worth, one of Southern Nevada’s Best Lawyers in In Business Las Vegas, one of the Best Lawyers in America in the Trusts & Estates category in The American Lawyer, one of the Best Lawyers in America in the Tax Law category in Corporate Counsel, named Nevada Super Lawyer in the Wills, Trusts & Estate Planning category in Nevada Business Journal, named Nevada Super Lawyer in the Estate Planning & Probate category in Las Vegas Life and named Mountain States Super Lawyer in the Estate Planning & Probate category in Law & Politics.

Jeramie P. Concklin,

Jeramie P. Concklin,

CEO, Guardian Solutions

Guardian Solutions is one of the nation’s leading commercial loan modification firms. Based on his extensive experience and success in restructuring commercial debt, Mr. Concklin speaks to commercial property owners, brokers and bankers at various industry events about effective restructuring of securitized commercial property debt.

Want To Attend For Free?

Here are two simple steps you can take to attend for free:

Step #1: Refer your friends. We’ll pay you a $100 referral fee for every person who registers. Just click the “Refer your friends” link in the previous sentence, sign up to get your affiliate link and follow the simple directions.

Step #2: After the event, send us your success story. Apply what you learn from this course, take action, and send us your success story (tell us how you accomplished your loan workout, as many specifics as you can about all your economic benefits, how great you felt about getting out from under this burden, etc.), give us permission to use your story and your first and last name and city in future marketing materials, and we’ll refund you $250 as our way of saying “Congratulations for taking action!”

Here are just some of the many testimonials from attendees of past Investor Education Institute Series Events:

“Information is clear, precise and organized.”

— Sky Kim, San Jose, CA

“Good value for the money …”

— Magor Sanders

“This may be the best event I ever attended!”

— David Kang

“Overall, really great value for your time and money.”

— Eric Rude

“Very hands-on, useful sessions on issues that really matter to the real estate investor.”

— Lynda Sands, San Diego, CA

FOR MORE INFORMATION or to register for The Ultimate Commercial Loan Workout Symposium CLICK HERE.

Special offer for friends of Hassle-free Cashflow Investing:

30% off registration! Use discount code: Campbell

We hope to see you at the Commercial Loan Workout Symposium in Los Angeles on July 6, 2011.

About the Author Ian Ghrist:

About the Author Ian Ghrist:

How to Predict Real Estate Prices

How to Predict Real Estate Prices

Tip of the week:

Tip of the week:

This graph illustrates the yin-yang relationship between pricing and quantity of buyers. The centerline represents market value. As you move above this market value, you attract a smaller percentage of prospective buyers, reducing your chances of a sale which typically increases the time it will take to locate a buyer at that price. Conversely, as you move below market value, you attract a much larger percentage of potential buyers which typically shortens the time it will take to locate a buyer at that price. One of the important take aways from this illustration is that there is a range of market prices for every property. Take appraisals with a grain of salt. Appraisers don’t provide a price range; they must isolate a single market value based on a subjective series of adjustments to historical prices. The marketplace where investors compete represents all of the “bid” and “ask” prices of buyers and sellers in real time. That’s why you will see buyers in a seller’s market paying higher than appraisal. That’s also why you will see sellers in a buyer’s market selling for less than appraisal.

This graph illustrates the yin-yang relationship between pricing and quantity of buyers. The centerline represents market value. As you move above this market value, you attract a smaller percentage of prospective buyers, reducing your chances of a sale which typically increases the time it will take to locate a buyer at that price. Conversely, as you move below market value, you attract a much larger percentage of potential buyers which typically shortens the time it will take to locate a buyer at that price. One of the important take aways from this illustration is that there is a range of market prices for every property. Take appraisals with a grain of salt. Appraisers don’t provide a price range; they must isolate a single market value based on a subjective series of adjustments to historical prices. The marketplace where investors compete represents all of the “bid” and “ask” prices of buyers and sellers in real time. That’s why you will see buyers in a seller’s market paying higher than appraisal. That’s also why you will see sellers in a buyer’s market selling for less than appraisal.

Unless you run in homeschooling circles, you probably aren’t familiar with this great book. It is an easy and quick read written at an 8th grade reading level. Although this book doesn’t contain the “Best Real Estate Investing Advice Ever”, the concepts in the book were nevertheless profoundly helpful to my business philosophy. The general concept is that clipper ships are much faster than cargo ships, but they also hold a lot less cargo. If you can be quick to market like a clipper ship, you will make a lot more profit than a cargo ship that enjoys cost efficiencies but is very slow to get to market. Remember in the 1990s when they piled Cabbage Patch dolls into the seats of 747’s so they could fly from China to the US in time to meet Christmas demand? The Cabbage Patch dolls that arrived a month after the Christmas rush were cheaper to produce but also sold for less than half as much. That’s a great example of the clipper ship strategy in action. Now go read the book! You can buy it on Amazon or through Blue Stocking Press and you’ll probably read it in one or two afternoons.

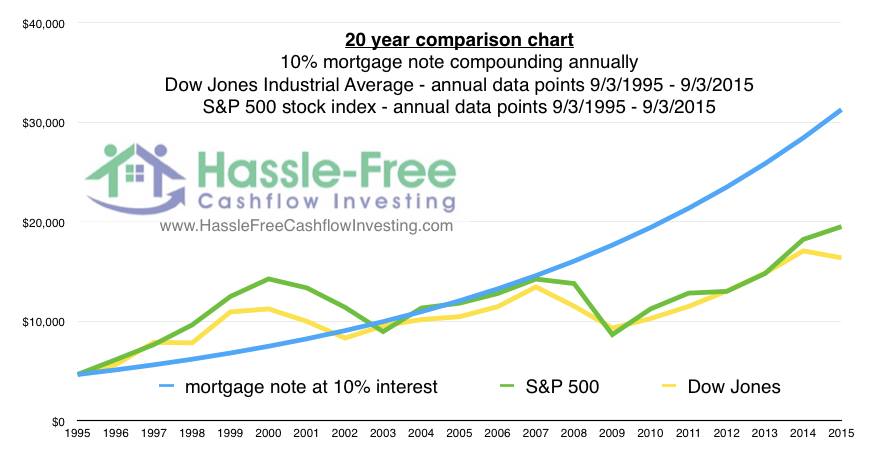

Unless you run in homeschooling circles, you probably aren’t familiar with this great book. It is an easy and quick read written at an 8th grade reading level. Although this book doesn’t contain the “Best Real Estate Investing Advice Ever”, the concepts in the book were nevertheless profoundly helpful to my business philosophy. The general concept is that clipper ships are much faster than cargo ships, but they also hold a lot less cargo. If you can be quick to market like a clipper ship, you will make a lot more profit than a cargo ship that enjoys cost efficiencies but is very slow to get to market. Remember in the 1990s when they piled Cabbage Patch dolls into the seats of 747’s so they could fly from China to the US in time to meet Christmas demand? The Cabbage Patch dolls that arrived a month after the Christmas rush were cheaper to produce but also sold for less than half as much. That’s a great example of the clipper ship strategy in action. Now go read the book! You can buy it on Amazon or through Blue Stocking Press and you’ll probably read it in one or two afternoons. Here’s some more of my best real estate investing advice that I wish I had included in my guest appearance on the “Best Real Estate Investing Advice Ever Podcast”: (1) if you’re afraid of the stock market, you should be!, (2) if you are afraid of debt, you’re doing it wrong, (3) if you think you can, you can, (4) if you think you can’t, you’re also correct.

Here’s some more of my best real estate investing advice that I wish I had included in my guest appearance on the “Best Real Estate Investing Advice Ever Podcast”: (1) if you’re afraid of the stock market, you should be!, (2) if you are afraid of debt, you’re doing it wrong, (3) if you think you can, you can, (4) if you think you can’t, you’re also correct.

On Monday January 26th, 2014 the price of a first class stamp in the US will be going up 6.5%, from $0.46 to $0.49. No one is really surprised by this, so where’s the lesson and how can it help you be a more successful real estate investor?

On Monday January 26th, 2014 the price of a first class stamp in the US will be going up 6.5%, from $0.46 to $0.49. No one is really surprised by this, so where’s the lesson and how can it help you be a more successful real estate investor?