Eleven Real Estate Investor Lessons You Can Learn From The US Postage Stamp

by professional investor David Campbell

On Monday January 26th, 2014 the price of a first class stamp in the US will be going up 6.5%, from $0.46 to $0.49. No one is really surprised by this, so where’s the lesson and how can it help you be a more successful real estate investor?

On Monday January 26th, 2014 the price of a first class stamp in the US will be going up 6.5%, from $0.46 to $0.49. No one is really surprised by this, so where’s the lesson and how can it help you be a more successful real estate investor?

Lesson 1: Utility – The utility of a stamp on Monday will be exactly the same as the utility of a stamp today. The VALUE or UTILITY of the stamp is the benefits that the stamp provides. Regardless of the price, the UTILITY of the stamp will remain the same; what really happened is that the utility or value of your CURRENCY went down. On Monday, it will take more dollars to buy the same amount of stamp utility you can buy today.

In real estate investor terms, the utility of a single family home is its ability to provide shelter. Over a thirty year period the utility of a four bedroom two bath home stays exactly the same. On day one, the house will provide the same amount of shelter it will in thirty years.

Lesson 2: It’s Not a Secret – The post office announced this price change on September 25, 2013. They gave you plenty of warning that the utility of your currency was about to go down by 6.5%. That’s a lot!!!

The Federal Reserve Bank, which has a substantial control over the utility of your currency (meaning the amount of stuff your dollar will buy), also announced in a press release on December 18, 2013 that “Inflation has been running below the Committee’s longer-run objective… of 2 percent.” You can insert your political opinion here regarding whether inflation is really running below 2% or not, but the point is nobody is keeping inflation a secret. The post office told you the utility of their service was going to stay the same but prices were going up. The Federal Reserve is giving you fair warning that the utility of your currency is going down by (at least) 2% a year if they can do anything about it.

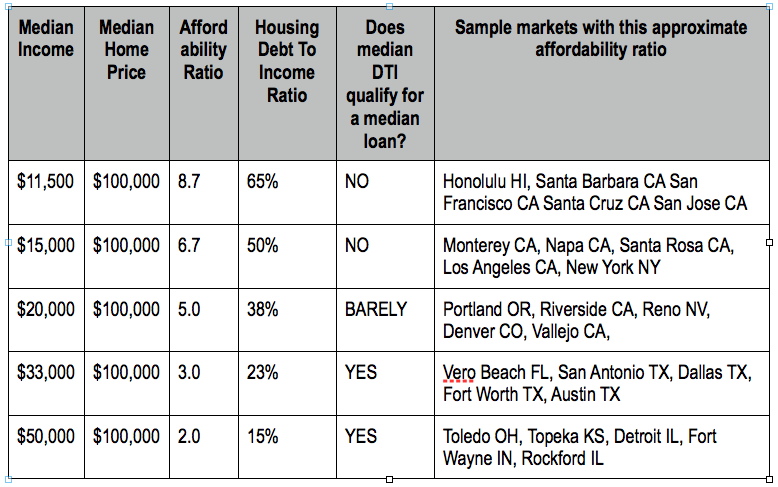

As a real estate investor, inflation makes it relatively easy and predictable to find properties that will make me money over the long term. I want to find a property that will preserve its utility over a long period of time, will be a hassle-free ownership experience for me, and cashflow along the way especially when inflation pushes up the rent. In my world as a real estate investor that means owning new or like new properties with professional management, in landlord friendly states, and purchased with creative deal structures that allow me to cashflow with as little money down as possible.

Lesson 3: Leverage – Let’s say you go out on Sunday and buy 10,000 postage stamps using all of the cash you have on hand. You’d be out of pocket $4,600. You could theoretically sell those stamps in less than 30 days to your short sighted friends and family who didn’t know the price of stamps were going up to $0.49 or who didn’t prepare and take action like you did. Maybe you sell them at a slight discounted price of $0.48 so you have a value proposition to offer. Your 1,000 stamps would sell for $4,800 in 30 days – a 4% profit in 30 days or a 48% annualized yield. That’s a pretty astounding return for such a simple investment, but at the end of the day you only made $200; not a lot of profit for the effort involved. Let’s take this exercise a step further… So you have an AMEX card with a $23,000 limit on it and you have $4600 in cash so you go buy 60,000 postage stamps at $0.46 for a total investment of $27,600 (OK they probably don’t have that many in stock, but just hang in there for the lesson). You have $4600 of your own cash invested and $23,000 of credit invested. That’s A LOT of stamps, so let’s say it takes you 60 days to sell all of those stamps and you wind up paying 18% annualized interest to AMEX for the privilege of borrowing the money for 2 months. At the end of 2 months your profit loss would look like this: 60,000 stamps sold at a discounted price of $0.48 = $28,800 less your initial investment of $27,600 less credit card interest of $690 equals a total profit of $510 divided by your initial cash investment of $4600 annualized equals a 67% annualized rate of return. The unleveraged version of this investment produced a 48% annualized yield and the leveraged version produced a 67% annualized yield. The takeaway is that the leveraged version of this deal produced both a larger gross profit and a larger annualized yield even when the interest rate was high because the investment yield was higher than the borrowing cost. I love real estate because there is an amazing amount of leverage available to a real estate investor. What other asset class can you borrow 75-95% of the purchase price and still produce positive cashflow after debt service?

Lesson 4: Scalability – In the above example, you made $510 of profit and there was virtually no risk involved. So you say “WOW, that is a genius business model, David. I’m ready to hop in the car and go buy stamps right now! I actually have $100,000 of investment capital available so let me run out and buy 217,391 stamps and I’ll make $20,000 on this flip.” The problem with this massive postage stamp flip is scalability. If you have a two cent profit per item, you need to sell A LOT of items to make any money and find a big enough market to absorb the item you are selling. One the best parts about being a real estate investor is that it is very scalable. If you make a 5% profit on a million dollar property, we’re talking about $50,000 and that is serious money! Even better, if you bought your million dollar property with only 5% down and your property goes up in price by 5% you’ve actually doubled your money.

Lesson 5: Historical Perspective – The price of a postage stamp was $0.10 when I was born in 1975, $0.29 when I graduated from high school in 1993, $0.32 when I graduated college in 1997, $0.42 when my first son was born in 2009, $0.46 today and $0.49 on Monday. The day I was born in 1975, someone could have purchased a decent home in the US for 400,000 ten cent postage stamps (or $40,000). Purchasing this same amount of “house utility” still costs 400,000 postage stamps in 2014, but the price of a stamp moved from $0.10 to $0.49 and the price of a decent home moved from $40,000 to $196,000. Even though the price of the home and the stamp have increased almost 500% in the past 38 years, the utility or value of both of these things remained the same.

Lesson 6: Making Money With Debt – Imagine buying a $40,000 house in 1975 using 100% financing and interest only payments. That means $40,000 loan with no principal payments would have the same loan balance in 2014 as it did in 1975. On the date you purchased the home the loan was worth 400,000 postage stamps and the home was also worth 400,000 postage stamps. If you sold this house in 2014, you would be able to sell it for … ta da! 400,000 postage stamps. The way you make money with this formula is that it only takes 61,224 postage stamps to repay the $40,000 mortgage in 2014 and you would receive the equivalent of 238,776 postage stamps as your profit. You started with zero postage stamps invested (remember 100% financing) and 38 years later you have 238,776 postage stamps, or $156,000, to show for your profit. Remember, the utility or value of the house did not change;he utility of the currency decreased as the government printed more of it. As the currency devalues, borrowers of good debt are making a profit. As a real estate investor, how much good debt would you like to control?

Lesson 7: What This Means For You As A Real Estate Investor – I’ll keep it as simple as I can: Buy real estate whose intrinsic value will remain the same or decrease very little over time. Finance that real estate with as much positively leveraged debt as you can while still maintaining neutral or positive cashflow. Wait two or three decades and the value of our currency and the value of the debt will both decrease in value. Pay off your debt with devalued currency and you will have lots of postage stamps… ahem… I mean dollars left over to show for your foresight. (Positive leverage means the CAP rate of the asset you purchased is higher than the interest rate used to purchase that asset. Positive leverage is an essential fundamental of the Hassle-Free Cashflow real estate investor philosophy.)

Lesson 8: If It’s That Simple Why Doesn’t Everyone Do It? – The price of postage stamps is going up 6.5% tomorrow. How many people are running to the store today to stock up on stamps? Not many, and that’s exactly my point. People know currency devaluation is happening and the majority of people aren’t doing anything to prepare for it. The post office and the Federal Reserve are both telling you your currency will continue to devalue. Now that you know what’s happening, what are you doing to not only protect yourself from inflation but to profit from it?

Lesson 9: Banks Love Inflation Too – Banks don’t lend their own money. They lend other people’s money. They collect deposits and then leverage those deposits by borrowing from other banks. They pay less than 2% interest on those deposits and loans and then they lend it out to other people for 4% or higher. The bank makes a spread on other people’s money. The bank doesn’t care if the currency is devaluing because the currency doesn’t belong to the bank; it belongs to their depositors. As the currency devalues, the prices of the assets securing the bank’s loans go up and the loan to value improves thus making the bank’s job easier to foreclose if needed. If you are a real estate investor paying attention, you should be asking “How do I get to be the bank?”

Lesson 10: The Big Take Aways – I hope you enjoy my real estate investor newsletter and the tons and tons of free real estate investor education and investment opportunities you can find on my blog. Our team at www.HassleFreeCashflowInvesting.com can help you buy positive cashflow rental houses with as little as a 5% downpayment using our proprietary real estate investor financing programs. We can help you BE THE BANK. If you could borrow money at 5% and invest it at 6% or more, how much money would you like to borrow? We can help you acquire brand new rental houses in the hottest rental market in the country (Dallas – Fort Worth Texas) that will cashflow with as little as 5% down. The more positively leveraged money you borrow the more property you control. The more property and good debt you control, the happier you will be when currency devaluation occurs. Remember, your property doesn’t have to go up in value to make a fortune; it only has to go up in price as a result of currency devaluation.

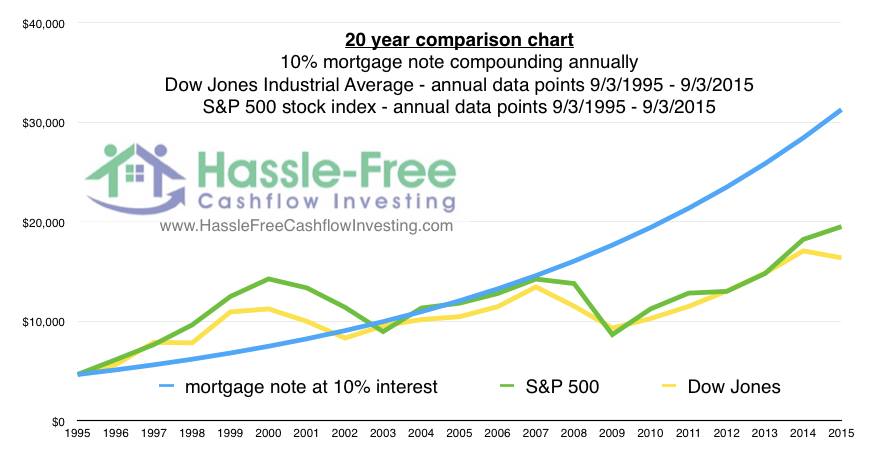

Lesson 11: How To Be The Bank – AMAZING MONEY MAKING BONUS -What if I were willing to loan you $60,000 at 5% interest and then borrow $60,000 back from you at 10% interest using my loan to you as collateral? You’d make a 5% profit ($3,000 a year) on the money I loaned to you and you’d have absolutely zero risk because if I defaulted on my loan to you, you would just tear up the note that you owe to me and we’d be even. That seems crazy so why would anyone in their right mind do this? There’s a perfectly logical reason, but if you want to find out that reason you’ll have to schedule a brief phone phone call with me! https://my.timedriver.com/WBYTQ There are always a few strings attached so let’s get them out in the open so we aren’t wasting each other’s time on a phone call talking about a real estate investor opportunity you aren’t qualified for. To qualify for this insanely simple and safe program you need to meet the following criteria:

(1) have a minimum credit score of 680 if you are a US citizen or an equivalent amount of strong credit if you are not a US citizen,

(2) you have a healthy job history and debt to income ratio which allows you to qualify for a conventional loan (if you have 10+ financed properties we can still help you),

(3) you can show a conventional lender a minimum of $40,000 in cash reserves ($80,000 if you are not a US citizen),

(4) you have a long term real estate investor mindset.

If you fit the financial criteria above and you’d like to make $250 a month or more as a passive private lender and real estate investor using my money you need to give me a call. Why would anyone lend you money at 5% and borrow it back at 10%. That seems like a terrible business decision?!?!? I guarantee when you get on a short phone call with me it will make sense very quickly. I can only accommodate about twenty investors into this risk-free, sounds-too-good-to-be-true-but-isn’t, private lending and real estate investor program so if you are interested, please schedule a call with me ASAP using this link to my calendar: https://my.timedriver.com/WBYTQ

Real Estate Investor Opportunities – Our team wears a lot of hats so we can provide diverse investment opportunities for our clients: We have brand new homes for sale in Dallas-Fort Worth Texas that create positive cashflow with as little as 5% down.

We buy and sell notes to help our income investors achieve cashflow. We currently have notes available for sale! Our supply of notes is relatively small and they usually sell very quickly to our inner core of clients who pick up the phone and make their investment objectives clear to us.

We aggregate real estate investor capital into private placement syndications (aka group investments) to buy net leased commercial properties.

We are a hard money lender and buyer of income producing notes. If you have quality notes for sale, give me a call.

If you are a real estate investor looking to increase your wealth and cashflow as a hassle-free cashflow real estate investor, try scheduling a 30 minute phone call with me to see if there is an opportunity for us to work together. https://my.timedriver.com/WBYTQ

Best regards,

David Campbell

Real Estate Investing Strategist

Founder of Hassle-Free Cashflow Investing

Office: (866) 931-9149 Ext. 1

Cell: (707) 373-9966

You may schedule a investor strategy consultation with professional real estate investor David Campbell by using this link to his online calendar. https://my.timedriver.com/WBYTQ

Keyword: real estate investor

How to Predict Real Estate Prices

How to Predict Real Estate Prices

On Monday January 26th, 2014 the price of a first class stamp in the US will be going up 6.5%, from $0.46 to $0.49. No one is really surprised by this, so where’s the lesson and how can it help you be a more successful real estate investor?

On Monday January 26th, 2014 the price of a first class stamp in the US will be going up 6.5%, from $0.46 to $0.49. No one is really surprised by this, so where’s the lesson and how can it help you be a more successful real estate investor?