By: David Campbell, professional investor, developer, and founder of Hassle-free Cashflow Investing

This article is a sequel to my last newsletter, but can easily stand on its own. You are invited to read and comment on part 1 and 2 of this article on my blog.

I am absolutely certain we will (continue to) see high rates of inflation for the foreseeable future. Inflation doesn’t mean commodities will increase in value, it just means commodities will increase in price because of a devaluation of our currency. If you understand what inflation is, and you believe it will continue, you can either be a victim or a beneficiary of the phenomena. I went to the grocery store recently and was amazed (but not surprised) at how much food prices have increased. Rising prices is confusing and frustrating to most Americans, but it is a fact of life we must come to accept and financially prepare for. Inflation has a winner and a loser. Unfortunately, most people come out losers because they cannot out-earn or out-save inflation. When I observe signs of inflation (rising prices) around me it does not affect me emotionally, because I have prepared to WIN from inflation. When inflation happens, savvy investors like me get richer while workers and savers get poorer. This doesn’t make me feel good about the situation, but it is the economic reality we live in.

I spend a lot of time talking about inflation and taxes because these are the most important and misunderstood concepts in your financial life. Inflation is a hidden federal tax upon every dollar in circulation worldwide. If you are the US government, inflation is an ingenious invisible tax; if you are anyone else, inflation is taxation without consent (and, for most people, without knowledge). I am about to show you ways to profit from inflation, but in no way do I believe inflation is a good thing for society. If I could stop inflation, I would. Since I can’t stop inflation, the best I can do is make a profit from it.

Here are four ways to profit from inflation:

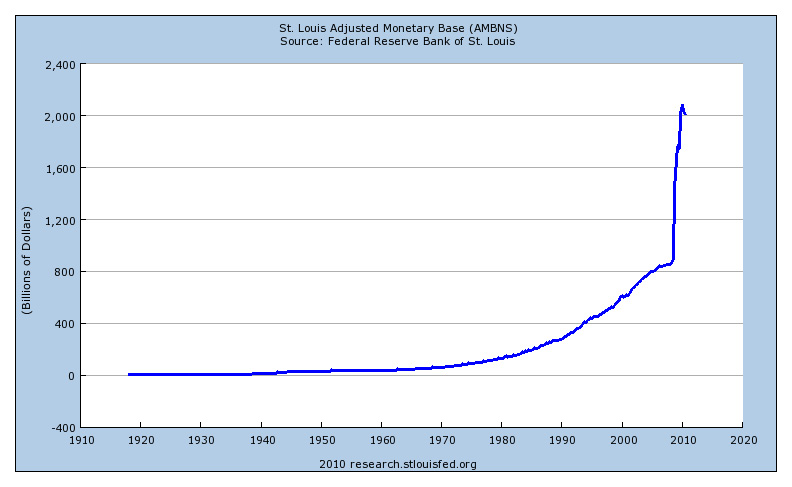

1) STEP ONE: purchase durable commodities today when the supply of dollars is less than the supply of dollars will be in the future. The durable commodities you purchase become assets on your balance sheet that maintain constant value while inflation drives prices up. When the supply of dollars increases and the supply of commodities remains the same, prices rise because more dollars are chasing the same basket of goods. Inflation as a result of increased money supply assumes demand for commodities has remained constant. If demand for commodities increases or decreases, there is a change in VALUE which may or may not result in a change in price. Value and demand are synonymous price is a metric of demand, money supply, and the velocity of money. We will talk about the velocity of money another day. Commodities may increase or decrease in value/desirability/demand, but inflation will make the PRICE of the commodity go up because of a looser money supply. For example, let’s say you bought a hammer in 1960 and it cost you $2.72. Over the past 50 years, the design and demand for hammers hasn’t really changed and therefore the value of a hammer in 1960 and in 2010 is exactly the same. Because the US currency has devalued (inflated), the price of the hammer is now $20. Over 50 years, the hammer has increased in price by 15% per year. RECAP: the value of the hammer didn’t change, but the price increased 15% per year because of inflation (15% per year is simple interest, but it can also be expressed as 4% annualized compounding rate of increase which is how inflation is usually described). If you had purchased a truckload of hammers in 1960 (for $2.72) and resold them at today’s inflated prices ($20), you would have a healthy paper profit that outpaced most investments even though the VALUE of the hammer DIDN’T CHANGE. While it is nice to find commodities that will increase in VALUE because of increased desirability or demand, it is easier to find commodities that will increase in PRICE because of inflation. Because of increases in the money supply (or increases in the velocity of money), it is possible to have a commodity drop substantially in value but resell at a higher price / profit.

2) STEP TWO: purchase durable commodities using as much debt as can be paid for by leasing out the durable commodity. Cash-flowing real estate is the perfect example of this. Real estate and hammers are examples of durable commodities, while oil or soybeans are examples of consumable commodities. No one will rent soybeans from you because they must be consumed to have value. Many people will rent real estate from you because it produces utilitarian value without consuming it. A bank will loan you most (sometimes all) of the money you need to buy an asset and the income from leasing the asset will pay off the loan. FREE MONEY! Now, let’s add inflation to the mix. Let’s pretend you bought a house in 1960 and the value of your house is 6,250 hammers and the price of a hammer was $2.72. (6,250 hammers x $2.72 per hammer = $17,000 house). Over the 50 years between 1960 and 2010 we know the money supply went through the roof and the price of things followed suit. Let’s assume the value of the house you bought in 1960 didn’t change over 50 years due to deterioration or increased demand and neither did the value of a hammer. In 2010, the value of your house would still be 6,250 hammers. However, as the supply of currency increased, the price of everything increased. Hammers went up in price and so did houses. If hammers now cost $20 ($20 per hammer x 6,250 hammers) your house must cost $125,000 even though the value didn’t change. What happened to the value and price of the debt? Let’s assume you had a 50 year interest-only loan on the property and you purchased it with 100% financing (eg. $17,000 of debt in 1960 and $17,000 of debt in 2010). This assumption is highly unlikely, but it makes our illustration easier to understand. Over 50 years, the price of the debt stayed the same while the value of the debt decreased. When you purchased the property, your debt was equal to 6,250 hammers or 100% of a house or $17,000. Sixty years later, $17,000 is only worth 850 hammers or 14% of a house. Inflation made the VALUE of debt decrease. If you know inflation is coming, you want to be a borrower of good debt (good debt is debt serviced by your tenants) and hold the debt as long as you can while the supply of currency increases. Thirty year fixed interest rate mortgages are on sale right now. Get as many of these mortgages as you can while the government is still subsidizing low interest rates.

3) STEP THREE: Protect your profits from income taxation. As the price of real estate goes up with inflation, there is no income tax on the gain until the property is sold for a profit. It is also possible for an investor to “borrow the profit” out of a property and reinvest it without paying a single penny of income tax. Many types of investments (interest income, business income, mutual funds, oil and gas, etc.) must pay income taxes on their profits every single year. Annual taxation of your profits radically erodes your return (earning power) because you lose the ability to generate compound earnings on the portion you paid in taxes. If you could double your money every year ($1 : $2 : $4), one dollar would equal one million dollars in twenty-one years. Apply a 30% income tax rate before each year’s doubling and twenty-one years results in only $41,000. Can you see how ESSENTIAL it is to have income tax deferral as a central component of your wealth building strategy? The equity growth in real estate is automatically tax deferred (like an IRA) while also creating a tax shelter for the ordinary income through depreciation of the real estate structures. Depreciation is a topic for another day.

4) STEP FOUR: Acquire income streams whose value will be enhanced by rising prices. Let’s assume rent has a fixed value of 60 hammers per month. In 1960 rent would be $163 per month (60 hammers x $2.72) and in 2010 rent would be $1200 per month (60 hammers x $20). The value of rent didn’t change, but the price changed because of increases in the supply of dollars (fiat currency). Let’s assume our rental house in 1960 had operating expenses of 28 hammers per month (taxes, insurance, maintenance, management) and mortgage payments of 30 hammers per month. There would be 2 hammers per month left over as the investor’s profit (60 hammers of income – 28 hammers of expenses – 30 hammers for mortgage). Over time, the PRICE of operating expenses will increase in direct proportion to the rate of inflation. However, the VALUE of operating expenses is not going up, the increase in the currency supply is making the PRICE of everything go up. Over time, the PRICE of your fixed interest rate mortgage will stay the same thus reducing its VALUE. In 1960, your mortgage is 30 hammers x $2.72 = $81.60/month. In 2010, your mortgage is still $81.60, but the price of a hammer has gone up with the money supply. Your mortgage in 2010 is $81.60 divided by $20 per hammer = 4 hammers. In 2010, you collect 60 hammers of income less 28 hammers of expenses (income and expenses didn’t change) less 4 hammers for mortgage = 28 hammers of investor profit (28 hammers x $20 = $560). The value of rent and expenses stayed the same, while inflation caused the VALUE of the mortgage to decrease therefore increasing the investor’s profit. Real estate is powerful because it allows you to control a very large amount of debt whose value is eroded by inflation. As the value of debt is eroded, the borrower of the debt wins. An investor doesn’t need the PRICE of his debt to decrease, to make a profit, he just needs the VALUE of his debt to decrease. If the cost of debt is 5% simple interest, but the rate of inflation was 15% simple growth between 1960-2010 it is obviously profitable to be a borrower of good debt during inflationary times (eg. borrow at 5% and earn 15% = 10% profit on the funds borrowed). Government inflation numbers are reported as compound rates of growth and that confuses people into thinking inflation is less of a factor than it really is. 4% inflation compounded annually over 50 years is the same as 15% simple interest. Here is an easy to use inflation calculator if you want to see how much the price of things have changed over the past 100 years.

In my next newsletter, I will prove the Federal Reserve must inflate the price of real estate by 50% or banks will continue to fail in huge numbers. There were 140 bank failures in 2009 and 149 bank failures in 2010. Here is an interesting interactive map showing where bank failures are occurring. What is worse for our economy, widespread bank failure or rapid inflation? The Fed has been explicit in its public commentary on this issue; aggressive inflation is preferable to continued bank failure, therefore heavy inflation must be targeted at the real estate sector to pull the banking industry out of its nose dive. The Fed has made its decree public knowledge. What are you going to do about it?

If you are like me and believe inflation is inevitable, how will you prepare yourself for it? Doing nothing means your savings and wages will be eaten up through increased consumer prices. Acquiring positive cash flow real estate with 100% financing makes you the ultimate winner during inflationary times.

Don’t become a victim of inflation! Acquiring Hassle-free Cashflow Real Estate is a very simple step towards prosperity in the coming years. If you would like help building a successful real estate portfolio, please call me right away while prices are low, long term interest rates are low, and banks are still lending to qualified buyers. Inflation is coming, and this beautiful buyer’s market will not last forever.

Best regards,

David Campbell

Real Estate Investor / Developer / Financial Mentor

Founder of Hassle-Free Cash Flow Investing

707-373-9966

David@hasslefreecashflowinvesting.com