Investing in Real Estate and Cashflow Producing Notes Using These Eight Hidden Sources of Capital

by Professional Real Estate Investor David Campbell

It is amazing how fast time goes. 2014 marks my fifteenth year investing in real estate and my tenth year as a real estate developer and syndicator. Long time readers of my blog will know that I started investing in real estate while I was a high school band director with no business training and no net worth. Over the past 15 years investing in real estate I’ve been fortunate to have had more real estate wins than losses (losses are an inevitable part of investing in real estate) and I am grateful for the amazing mentors and life experiences that have helped me get to where I am today. Growing a successful real estate investment, brokerage, and development company out of humble beginnings has taught me a lot of lessons that I would like to share with you.

You can find many of those lessons reading my blog and free eBooks and enjoying the free video training at: http://www.hasslefreecashflowinvesting.com/video/

Here is a question I get asked all the time: “How did you become so successful investing in real estate when you started with no money?” What the asker is usually thinking is: “How do I become successful investing in real estate with a limited amount money?” Whether you have $100 to invest or $100 million to invest, everyone’s personal financial resources are limited. Don’t feel intimidated by investing in real estate just because you don’t have a large bank account. A great mentor once told me “Never let lack of capital get in your way of doing a good deal. If the deal is good and you know how to tell the story of a good deal someone will fund it.” As an innovating investor I took those words of encouragement one step further and looked for creative ways to fund my real estate growth. Below are a handful of creative ideas to help you improve your wealth and passive income investing in real estate regardless of how much capital you are currently starting with.

Disclaimer: Ideas can be powerful tools. Please remember in the hands of an untrained user, any tool can also be dangerous. Please digest these ideas with a air of caution and if you decide to implement any of these strategies I encourage you to reach out to an experienced financial mentor to discuss your plans. A good mentor may help you identify pitfalls you may not have thought of. For example, some of the ideas listed below are legitimate strategies when working with private financing and commercial lenders, but these creative financing techniques may not work or worse could get you into legal trouble when working with conventional “Fannie Mae” style residential lenders. I am not a tax advisor or a legal advisor; check with your team of professionals before committing to any financial decisions!

Hidden Capital Source #1: Self-directed IRA – If you are self-employed or have IRA funds saved from when you worked at a previous employer, you can roll those funds into a self-directed IRA and use those funds for investing in real estate and notes. If you earn $1 and put it into a tax deferred IRA you will have $1 to invest. If you are in a 40% tax bracket and don’t defer the tax, you earn $1 and have $0.60 to invest. That means you need a 67% profit just to break even ($0.60 x 167% = $1)! If you would like to learn more about self-directed IRA investing here are some great free training videos for you: http://www.hasslefreecashflowinvesting.com/video/ira-tax-videos/

Hidden Capital Source #2: 401(k) loan – If you have a 401(k) plan you may be able to borrow against your 401(k) to create a pool of cash to invest for investing in real estate. (Check with your plan administrator and tax advisor to make sure this would work for you!) If you use the proceeds of your 401(k) loan for investing in real estate you may be able to pay interest to your 401(k) that is tax-deferred income to your 401(k) (A GOOD THING) and take a present day interest expense tax deduction on your personal tax return (A GOOD THING). Let’s say you borrowed $50,000 from your 401(k) for investing in real estate and then paid 4% interest per year to your 401(k), your 401(k) would be earning a 4% return ($2000), tax deferred, while you would have a $2000 deduction on your personal return. Let’s say you then invested the $50,000 from your 401(k) into a note and trust deed that paid 10% ($5000 profit per year). You would have $5000 of interest income less $2000 of interest expense (to your 401(k) which means $2000 of your note income would be tax deferred as earnings to your 401(k) and $3000 would be taxable to you personally in the current year. While it might be better tax planning to own the note directly in your 401(k) it might be logistically impossible to do so. For example if your 401(k) is invested in your current employer’s plan and you are unable to roll it over into a self-directed plan, most employer sponsored IRA plans will not let you self-direct your IRA into notes and real estate, but they may let you take out a loan against your own 401(k) and pay yourself interest.

Here’s a potentially better tax plan for investing in real estate with your 401(k) funds. Let’s say you borrowed $50,000 from your 401(k) and purchased a $250,000 rental house with 80% financing and 20% down. Let’s say the rental house was a 6 CAP rate

($250,000 purchase price x 6 CAP rate = $15,000 Net Operating Income)

and you borrowed 80% of the money from the bank at 5%

($200,000 bank loan x 5% bank interest rate = $10,000 interest expense to bank)

and you pay back your 401(k) loan at 4% interest

($50,000 401(k) loan x 4% interest = $2,000 interest expense to 401(k))

Your gross real estate profit from rental activities would be $3,000

$15,000 NOI – $10,000 interest to bank – $2,000 interest to 401(k) = $3,000 profit

However, this $3,000 profit is before we add in the tax loss from depreciation. Assuming a $250,000 rental property is $30,000 land and $220,000 structure and we depreciate the structure over 27.5 years we get an $8,000 tax loss from depreciation.

$3,000 profit less $8,000 in depreciation results in a $5,000 tax loss

***Check with your tax advisor about all income tax related issues. Nothing on this website should be considered tax advice.***

So let’s recap this strategy…

EXAMPLE 1: By borrowing $50,000 from your 401(k) and purchasing a note you create profit and positive cashflow inside and outside of your 401(k). You would be creating tax deferral on the funds going into the 401(k) but you would have a taxable event in the current year on the profit that is in excess of the interest charged by your 401(k). Talk with your 401(k) plan administrator and tax advisor to see if you have control over the interest rate charged to yourself by your 401(k) and also confirm with your plan administrator that the interest you pay to your 401(k) accrues to your benefit rather than to the benefit of the plan administrator.

EXAMPLE 2: By borrowing $50,000 from your 401(k) and purchasing a $250,000 rental property you are creating tax deferred interest income and cashflow inside of your 401(k) as well as a “phantom loss” on your personal tax return in the current year. This “phantom loss” may or may not be able to offset other income you’ve earned depending on your personal tax situation. Although the property is showing a paper loss (aka phantom loss) the property itself is profitable because you borrowed all of the money at an interest rate lower than the earning rate of the property. Investing in real estate at a CAP rate higher than the cost of borrowing is called positive arbitrage and this is a key component of the Hassle-Free Cashflow Investing philosophy. CAVEAT: even though the property in this example is profitable and creating a phantom loss (which are both good things) it could result in negative cashflow because the amortization on the bank loan in addition to the shorter term amortization on the loan to your 401(k). Remember, not all profitable investments are positive cashflow and not all negative cashflow investments are bad.

Hidden Capital Source #3: Cash value life insurance. I got the downpayment for my first rental property by taking a loan against a cash value life insurance policy my dad purchased for me when I was a kid. You can learn more about investing in real estate using cash value / permanent life insurance and the “infinite banking concept” by watching this great video webinar with myself and Patrick Donohoe from Paradigm Life. http://www.hasslefreecashflowinvesting.com/video/cash-management-strategies-for-real-estate-investors/

Hidden Capital Source #4: Deploying existing real estate equity owned by you or your friend. This is a potentially obvious investment strategy that I am going to put a creative twist on for you. Investing in real estate or notes using a cash out mortgage or line of credit against real estate you already own can have very powerful results and can often improve your cashflow and LOWER your risk. Here’s how: My client owned a primary residence valued at $500,000 and had a $300,000 first mortgage and $200,000 of equity. The client refinanced the property with a new $400,000 first mortgage and pulled out $100,000 of investment capital. His net worth was the same before and after the refinance; he just moved half of his equity into cash. He then took the cash and purchased two $50,000 notes totaling $100,000, secured by $140,000 worth of real estate. The client borrowed the money from his primary residence at 4% and invested it into notes paying 10%.

$100,000 borrowed capital x 4% = $4,000 interest expense

$100,000 invested capital x 10% = $10,000 interest income

$10,000 interest income – $4,000 interest expense = $6,000 annual profit

On a simplistic basis, we can see this was a profitable move because the fixed cost of funds was lower than the fixed earning rate. Let’s look a little deeper at the cashflow on this deal.

The $100,000 of extra mortgage expense at 4% on a 30 year fully amortized loan is a cashflow outgo of $477/month.

The $100,000 investment notes at 10% interest on a 15 year fully amortized loan is a cashflow income of $1,075/ month.

$1,075 cash in less $477 cash out = $598 positive cashflow

(Albeit, not all of the $598 is profit because we are dealing with principal and interest payments using two different amortization schedules (expense is 30 year and the income is 15 year).

The above is a great example of how being a borrower and using the concept of positive arbitrage can improve cashflow. The investor client is happy because he improved his cashflow position by $598 per month simply by signing his name a few times, but he is also happy because this situation LOWERED his risk. Here’s how:

When your monthly cashflow improves, your risk goes down because you have more liquidity to service your debts and build up cash reserves.

When the investor moved $100,000 of equity from his home into first position debt secured by other real estate, he moved the asset from higher risk “equity” to lower risk “senior debt”. Let me go deeper into this concept. If the investor loses his job or credit in the future, he would be unable to tap the equity in his home without selling his primary residence. However, by moving the equity from his home into first position liens on other property, he has the peace of mind that if he ever loses his job and wants to tap the equity in his home, he can always liquidate the notes for cash.

The investor has also insulated his assets from the potential of real estate price declines. If the investor had not moved his equity from his primary residence and real estate prices decline 40%, his $500,000 property would be worth $300,000, less the $300,000 of original debt, so his net equity would have gone from $200,000 to $0. If he sold his house at this point in the market, he would have zero cash from the sale and he certainly wouldn’t be able to refinance any equity out of her home because there would be no equity.

By moving his equity into first position notes, his liquidity is more insulated from loss. His $500,000 property declines to $300,000. Less $400,000 of debt, that means he has a $100,000 negative equity in his primary residence but he doesn’t have to sell his primary residence until the market recovers. Remember, when investing in real estate the value of a property only matters when you are selling or refinancing. The main concern the investor is insulating against is not a change in profitability but a change in access to liquidity. Even if the notes go bad (always a risk), the investor will end up owning the underlying real estate. Ideally, the foreclosed houses would make great rental properties and would produce more rental income than what he was originally receiving in interest income from the previous owner. However, if he decided to sell the foreclosed real estate, even if that real estate had gone down in value, it would not have declined to zero as the equity in his home did. Moving your at risk “junior” equity into positively arbitraged “senior” notes while you have the equity and credit available to you would be the lesser of two evils in the event of large price declines.

Here is another risk mitigating bonus for my investor client: The investor owned a home in a high priced state and was concerned that the state’s economy and home prices might be fragile and unaffordable in the future. He moved his at risk “junior” equity from his high priced state into “senior debt” secured by entry level real estate in Dallas, Texas, which is a more vibrant and diverse economy. The investor felt that moving the equity out of his primary residence into a senior debt allowed him to (1) improve his immediate cashflow, (2) allow him to have access to this equity in the future regardless of his employment or credit position, (3) gave him options for liquidity in the future even if there are massive price declines, and (4) it gave his investments geographic diversity by moving a portion of her equity to Texas.

Hidden Capital Source #5: Cash advance credit cards – Here is a practical application on the idea of positive arbitrage that has merit but comes with some powerful caveats. I have a client with the ability to borrow from his credit cards at a teaser rate of 0% for 12 months. The client borrowed $10,000 from his credit card for 18 months and invested in a $10,000 note and deed of trust paying 10% that had a due date in 12 months. The client borrowed the money at 0% and invested at 10% which generated a 10% yield spread.

$10,000 trust deed x 10% interest rate – $10,000 credit card loan x 0% teaser rate = $1,000 profit

The client used the $1,000 interest income generated from this “arbitrage play” to pay down some of his longer term student loan debt. It’s another example of borrowing for profit. There is a risk that the credit card teaser rate would expire and reset to 18% before the note and trust deed were paid off so the investor made sure that if the note and deed of trust were not paid by the 12 month due date the note would have a default interest rate of 18%, which is the same as his credit card interest rate. A big consideration for this type of arbitrage play is that your FICO score will be negatively impacted for the period of time your credit cards are drawn more than 50% of their available credit line. However, when you pay off the credit card at the end of the borrowing period your FICO should improve. You probably don’t want to use this strategy if you are about to apply for financing on a new real estate purchase. And while this strategy could work well in investing in shorter term notes, you probably don’t want to use this strategy for investing in real estate as a long term investment unless you are confident you have another way to repay the credit card before the interest rate increases.

Hidden Capital Source #6: Barter your services or personal property – I once had one of our company’s vendors express interest in investing in real estate by purchasing a home built by my home building company. The vendor could qualify for the loan but didn’t have the down payment. We signed a seven year service contract with the vendor and paid the vendor for all seven years in advance. The vendor gave us a slight discount for pre-paying for his service. The vendor then used the lump sum of cash we paid to him as the downpayment on a property we built and sold to him. This was a win for the vendor because he got a seven year contract out of us when we previously had a month to month relationship and the vendor got to purchase a house he could not previous afford to because he didn’t have the down payment. This was a win for our home building company because the profit on the sale of the house exceeded the amount we advanced to the vendor and we got the added bonus of a slight discount on a vendor’s services we were going to purchase anyway. In the past, I’ve offered to accept vehicles or musical instruments or jewelry or land as the downpayment on houses. If you’re looking investing in real estate or a trust deed and you have personal property or land that you’d like to use as your downpayment, give me a call. I would love to work with you. Often times I have taken my real estate equity or real estate broker commission in a promissory note or co-ownership in a property. If you would like help investing in real estate or an income producing note and you want a broker to co-invest their commission with you give me a call at 866-931-9149 x1 and we’ll see what we can put together.

Hidden Capital Source #7: Investment partners / syndication – When I find a good investment larger than what I can purchase with my own capital I go to my investor clients to form a partnership or real estate syndication. Investing in real estate using partners can be a very complex subject but it is something I have gained a lot of experience with. Here is a great video with myself and real estate attorney Jeff Lerman teaching a free one-hour course called “Partnering for Profit” http://www.hasslefreecashflowinvesting.com/video/partnering-for-profit/

Hidden Capital Source #8: the seller’s bank – Here is a great strategy for investing in real estate that works especially well with commercial properties: On multiple occasions, I have met commercial real estate sellers who owe slightly more money on their property than it is worth as a cash sale. A great investing formula is to get the property in contract with the seller for the best price you can (usually what they owe on the property) and then go to the seller’s bank and say, “Mr. Banker, you currently have a loan on such and such property for $1m and the property is really only worth $975,000. I know you typically require a 25% downpayment on commercial real estate, but I am only interested in buying this property (for more than its worth) if you will give me special financing terms to buy this property. I would like to reduce your loan from $975,000 to $900,000 and I will give you a personal guarantee that is worth more than the seller’s personal guarantee. Will you do this?” Usually the bank will say no. However, you can explain to the banker that if the seller pursues a cash sale it will probably result in a short sale for the bank. If the bank will cooperate with you by offering a higher than normal LTV loan you will lower the bank’s debt / risk position in the property by slightly paying down the existing loan, provide superior management to the asset, and provide a superior personal guarantee on the loan. It doesn’t happen often, but I have been successful acquiring high LTV property using this strategy. There are an infinite number of variations on this strategy, but the key points to remember are: how do you make the situation into a win for a bank who has a problem (loan overexposure and risk), a win for the seller (who has a loan/property they think will be a short sale), and a win for the buyer (who is willing to slightly overpay for a property to get superior financing terms from the seller’s bank).

In addition to these hidden sources of capital for investing in real estate and cashflow producing notes, I encourage you to also watch this free video series where we discuss your “Eight Essential Resources” and how to use them to produce real estate profits: http://www.hasslefreecashflowinvesting.com/video/secrets-of-hassle-free-cashflow-real-estate-investing/

If you would like help formulating your personal investment strategy or if you would like to learn about current Hassle-Free Cashflow investment opportunities please give me a call at 866-931-9149 ext 1 or schedule our phone call using this link to my calendar. https://my.timedriver.com/WBYTQ

To your success!

David Campbell

Real Estate Investing Strategist

Office: (866) 931-9149 Ext. 1

Cell: (707) 373-9966

Keyword: investing in real estate

CLICK HERE TO LISTEN TO: Episode 81 of the Invest Florida Podcast with host Eric Odum and featured guest David Campbell – founder of Hassle-Free Cashflow Investing. David and Eric talk about investing in mortgage notes and making hassle-free cashflow as a private lender.

CLICK HERE TO LISTEN TO: Episode 81 of the Invest Florida Podcast with host Eric Odum and featured guest David Campbell – founder of Hassle-Free Cashflow Investing. David and Eric talk about investing in mortgage notes and making hassle-free cashflow as a private lender. Tip of the week:

Tip of the week:

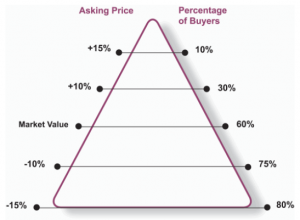

This graph illustrates the yin-yang relationship between pricing and quantity of buyers. The centerline represents market value. As you move above this market value, you attract a smaller percentage of prospective buyers, reducing your chances of a sale which typically increases the time it will take to locate a buyer at that price. Conversely, as you move below market value, you attract a much larger percentage of potential buyers which typically shortens the time it will take to locate a buyer at that price. One of the important take aways from this illustration is that there is a range of market prices for every property. Take appraisals with a grain of salt. Appraisers don’t provide a price range; they must isolate a single market value based on a subjective series of adjustments to historical prices. The marketplace where investors compete represents all of the “bid” and “ask” prices of buyers and sellers in real time. That’s why you will see buyers in a seller’s market paying higher than appraisal. That’s also why you will see sellers in a buyer’s market selling for less than appraisal.

This graph illustrates the yin-yang relationship between pricing and quantity of buyers. The centerline represents market value. As you move above this market value, you attract a smaller percentage of prospective buyers, reducing your chances of a sale which typically increases the time it will take to locate a buyer at that price. Conversely, as you move below market value, you attract a much larger percentage of potential buyers which typically shortens the time it will take to locate a buyer at that price. One of the important take aways from this illustration is that there is a range of market prices for every property. Take appraisals with a grain of salt. Appraisers don’t provide a price range; they must isolate a single market value based on a subjective series of adjustments to historical prices. The marketplace where investors compete represents all of the “bid” and “ask” prices of buyers and sellers in real time. That’s why you will see buyers in a seller’s market paying higher than appraisal. That’s also why you will see sellers in a buyer’s market selling for less than appraisal.

Unless you run in homeschooling circles, you probably aren’t familiar with this great book. It is an easy and quick read written at an 8th grade reading level. Although this book doesn’t contain the “Best Real Estate Investing Advice Ever”, the concepts in the book were nevertheless profoundly helpful to my business philosophy. The general concept is that clipper ships are much faster than cargo ships, but they also hold a lot less cargo. If you can be quick to market like a clipper ship, you will make a lot more profit than a cargo ship that enjoys cost efficiencies but is very slow to get to market. Remember in the 1990s when they piled Cabbage Patch dolls into the seats of 747’s so they could fly from China to the US in time to meet Christmas demand? The Cabbage Patch dolls that arrived a month after the Christmas rush were cheaper to produce but also sold for less than half as much. That’s a great example of the clipper ship strategy in action. Now go read the book! You can buy it on Amazon or through Blue Stocking Press and you’ll probably read it in one or two afternoons.

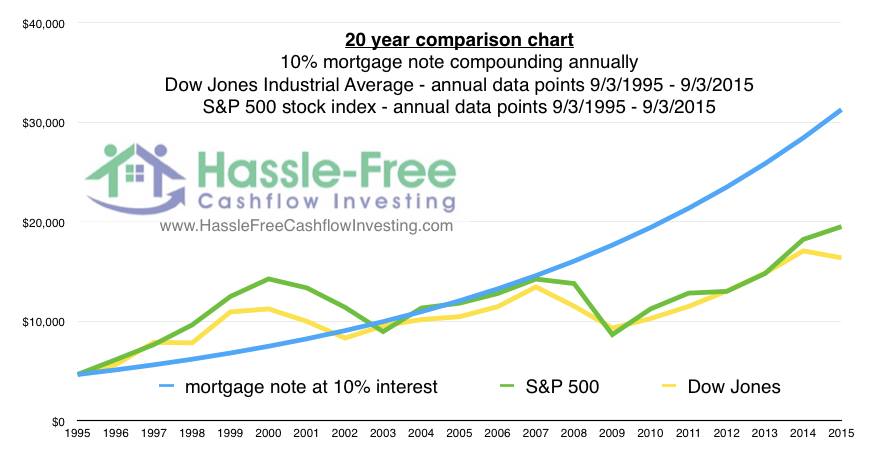

Unless you run in homeschooling circles, you probably aren’t familiar with this great book. It is an easy and quick read written at an 8th grade reading level. Although this book doesn’t contain the “Best Real Estate Investing Advice Ever”, the concepts in the book were nevertheless profoundly helpful to my business philosophy. The general concept is that clipper ships are much faster than cargo ships, but they also hold a lot less cargo. If you can be quick to market like a clipper ship, you will make a lot more profit than a cargo ship that enjoys cost efficiencies but is very slow to get to market. Remember in the 1990s when they piled Cabbage Patch dolls into the seats of 747’s so they could fly from China to the US in time to meet Christmas demand? The Cabbage Patch dolls that arrived a month after the Christmas rush were cheaper to produce but also sold for less than half as much. That’s a great example of the clipper ship strategy in action. Now go read the book! You can buy it on Amazon or through Blue Stocking Press and you’ll probably read it in one or two afternoons. Here’s some more of my best real estate investing advice that I wish I had included in my guest appearance on the “Best Real Estate Investing Advice Ever Podcast”: (1) if you’re afraid of the stock market, you should be!, (2) if you are afraid of debt, you’re doing it wrong, (3) if you think you can, you can, (4) if you think you can’t, you’re also correct.

Here’s some more of my best real estate investing advice that I wish I had included in my guest appearance on the “Best Real Estate Investing Advice Ever Podcast”: (1) if you’re afraid of the stock market, you should be!, (2) if you are afraid of debt, you’re doing it wrong, (3) if you think you can, you can, (4) if you think you can’t, you’re also correct.

On Monday January 26th, 2014 the price of a first class stamp in the US will be going up 6.5%, from $0.46 to $0.49. No one is really surprised by this, so where’s the lesson and how can it help you be a more successful real estate investor?

On Monday January 26th, 2014 the price of a first class stamp in the US will be going up 6.5%, from $0.46 to $0.49. No one is really surprised by this, so where’s the lesson and how can it help you be a more successful real estate investor?