How Brexit May (or May NOT) Affect Your US Real Estate Portfolio

this article was written by Nick Eddy – real estate investor, practicing attorney, and guest blogger at Hassle-Free Cashflow Investing.

On June 23rd the United Kingdom voted to leave the European Union. The Brexit vote came as a surprise to most considering recent polls showed voters preferred to remain part of the EU. Regardless, by the time the polls had closed it became obvious the UK would sever its ties with the EU. The Brexit vote was quickly followed up with British Prime Minister David Cameron, a staunch supporter of remaining within the EU, announcing his resignation.

Then, the world financial markets took a drastic tumble. Right away, pundits and gurus began to speculate on how Brexit would affect the US real estate market. The majority of these pundits seemed to speculate that for US real estate investors, Brexit would be great. Generalized widespread statements were made that “US real estate demand and prices will increase.” However, with this article we’re going to point out that the pundits’ predictions may not be accurate for your properties. Not all US real estate investors will receive this Brexit windfall. Let’s take a closer look at how the Brexit vote might actually affect your portfolio.

- Lower Mortgage Rates

With the surprising Brexit vote people got nervous. Suddenly, the world seemed a little less stable. This type of fear and uncertainty tends to play out in the economy, often resulting in lower interest rates. US real estate investors may really benefit here. Interest rates were already historically low, but the new turmoil in Europe will likely hold down these low rates even longer. Given the Fed’s recent tendency to wait and see, it’s seems likely rates will be kept low for a while as they see how Brexit plays out in the world economy.

So what does this mean for your US real estate portfolio? First, look at your properties that currently have good equity and consider pulling the cash out with a refinance. You should be able to lock in a nice low rate. I just had an offer accepted on two different duplexes and the interest rate I received on those properties was a mere 3.5%, which is terrific for non-owner occupied property.

With lower interest rates we may also see an increase in property values. When prospective buyers do the math on how much house they can afford every month, they’ll see they can afford to pay a higher price for the home because of historically low interest rates. This will likely increase property values in a lot of markets throughout the US. However, be careful not to rely on this Brexit appreciation—it may never come to your market. (*** editorial comment by David Campbell … “In my research, income producing commercial real estate values and interest rates are directly correlated, but historical data has shown us – almost counterintuitively – that there is no correlation between the price of owner occupied residential real estate and mortgage interest rates .”)

- Foreign Real Estate Investors Will Flock to (SOME) US Markets

The majority of pundits told us that US real estate prices would increase because foreign investors who once invested heavily in the UK housing market will start to put their money in the US housing market. Since all real estate is local, it’s a little bit more complicated than that.

For years, London and other major UK cities were a go to place for foreign investors—particularly for Chinese and Middle Eastern investors. And there is no doubt Brexit has had, and will continue to have, a negative effect on UK real estate values—but, that does not mean these foreign investors will start buying property in your market. Typically, these foreign investors buy high end luxury properties in top markets. They buy vacation homes on the beach and plush condos in the heart of major cities. So it is likely demand will go up as foreign investors look to buy property in the US, but it’s likely to be in markets like Manhattan, San Francisco, and Miami. I own rental properties in the rural Midwest. They are great properties that generate solid cash flow, but I don’t expect the value of those properties to increase due to foreign investor interest. These properties are over an hour away from any major airport. I just cannot imagine a wealthy Chinese investor coming into my small rural town and purchasing a bunch of real estate.

As more high end properties in large markets are gobbled up by new foreign investors, we may see demand trickle down to other segments of the market. New foreign investors will drive up prices in larger markets, which will send US investors to middle and possibly low market properties. This could end up eventually causing values to increase in smaller markets.

- Frustrated Wall Street Investors will Look to Real Estate

In the wake of the Brexit vote the Dow lost over 270 points and the S&P 500 dropped over 1.5%. Many of the gains investors made in the stock market over 2016 were reversed in one week, and many indexes are now below their 2015 closing values. Frustrated and burned investors focused on the stock market will start to look for their gains elsewhere.

With this potentially new influx of US real estate investors it’s important to be careful where you purchase your properties. Beware of markets where yield is being compressed by foreign investors. Instead, stay in markets that are out of the spotlight, but have the right metrics where the numbers still work well. Also, consider selling your high priced properties in high end markets and exchange them for cash flow properties off the Brexit price increase radar.

Conclusion

With the Brexit vote the pundits almost unanimously claimed that US real estate values would increase. We must keep in mind that all real estate is local. There is no single US real estate market. While Brexit may increase the value of a New York based investor’s portfolio, an Indianapolis based investor may not experience that same gain. We must continue to do our own due diligence on every deal.

All the best,

Nick Eddy – Esq.

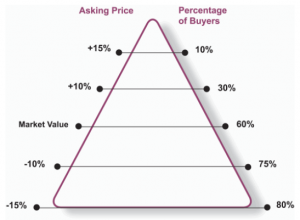

This graph illustrates the yin-yang relationship between pricing and quantity of buyers. The centerline represents market value. As you move above this market value, you attract a smaller percentage of prospective buyers, reducing your chances of a sale which typically increases the time it will take to locate a buyer at that price. Conversely, as you move below market value, you attract a much larger percentage of potential buyers which typically shortens the time it will take to locate a buyer at that price. One of the important take aways from this illustration is that there is a range of market prices for every property. Take appraisals with a grain of salt. Appraisers don’t provide a price range; they must isolate a single market value based on a subjective series of adjustments to historical prices. The marketplace where investors compete represents all of the “bid” and “ask” prices of buyers and sellers in real time. That’s why you will see buyers in a seller’s market paying higher than appraisal. That’s also why you will see sellers in a buyer’s market selling for less than appraisal.

This graph illustrates the yin-yang relationship between pricing and quantity of buyers. The centerline represents market value. As you move above this market value, you attract a smaller percentage of prospective buyers, reducing your chances of a sale which typically increases the time it will take to locate a buyer at that price. Conversely, as you move below market value, you attract a much larger percentage of potential buyers which typically shortens the time it will take to locate a buyer at that price. One of the important take aways from this illustration is that there is a range of market prices for every property. Take appraisals with a grain of salt. Appraisers don’t provide a price range; they must isolate a single market value based on a subjective series of adjustments to historical prices. The marketplace where investors compete represents all of the “bid” and “ask” prices of buyers and sellers in real time. That’s why you will see buyers in a seller’s market paying higher than appraisal. That’s also why you will see sellers in a buyer’s market selling for less than appraisal.