The feedback I get from investors across the country is that we are in a seller’s market. Prices are up. Inventory is low. Properties in the hottest markets are selling over asking price with multiple offers. Investors are paying “more than they want to” just to get a deal done. The ratio between rents and purchase price is favoring sellers and squeezing investor buyers out of the market. Another way to describe this trend is that CAP rates are decreasing, or “compressing”. We are approaching a delicate part of the market cycle where the flood of inexperienced investors is driving prices up to places where experienced investors shake their head and wonder, “How is the winning bidder ever going to make a profit?”

Wouldn’t life as an investor be easier if the market gave you clear signals about the future? Interpreting investment signals is a mix of science, artistry, and luck with a bit of clairvoyant magic thrown in. In today’s blog, I’ll share a few of the directional signals I use in making real estate investment decisions. I will also talk about what investment strategies and buying opportunities I am excited about in today’s seller’s market.

A common mistake investors make in reading market signals is what I call, “You see what you look for and you look for what you know.” If you are seeing prices going up all around you and all you are looking at is prices, it would be natural to assume that if you buy now the price will go up next month. As sophisticated investors, we know this is not true and we need to learn to look beyond price and historical price trends. Appraisers are trained to look at what price similar properties sold for in the past 3-6 months. Appraisers are required to always look in the rear view mirror at prices in the past. In an upwardly trending market, homes will be selling higher than appraised value. It makes sense that if your home is in contract at a price higher than the previous sales comps, it won’t appraise at the contract price. A low appraisal doesn’t mean a home isn’t worth the contract price. A property is worth what a reasonably motivated buyer and seller agree to. A maxim to remember in real estate: “You will overpay for every property you ever buy; if someone else is willing to pay more, they, not you, will become the property owner.”

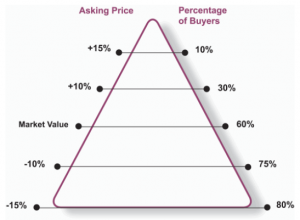

Simple economics teaches us that as you lower the price of your property there are more buyers. As you raise the price of your property there are fewer buyers. However, if you only have one property to sell, you only need one willing buyer. In a seller’s market, the seller of a performing income property is not typically in a rush to discount the price to find a buyer.

This graph illustrates the yin-yang relationship between pricing and quantity of buyers. The centerline represents market value. As you move above this market value, you attract a smaller percentage of prospective buyers, reducing your chances of a sale which typically increases the time it will take to locate a buyer at that price. Conversely, as you move below market value, you attract a much larger percentage of potential buyers which typically shortens the time it will take to locate a buyer at that price. One of the important take aways from this illustration is that there is a range of market prices for every property. Take appraisals with a grain of salt. Appraisers don’t provide a price range; they must isolate a single market value based on a subjective series of adjustments to historical prices. The marketplace where investors compete represents all of the “bid” and “ask” prices of buyers and sellers in real time. That’s why you will see buyers in a seller’s market paying higher than appraisal. That’s also why you will see sellers in a buyer’s market selling for less than appraisal.

This graph illustrates the yin-yang relationship between pricing and quantity of buyers. The centerline represents market value. As you move above this market value, you attract a smaller percentage of prospective buyers, reducing your chances of a sale which typically increases the time it will take to locate a buyer at that price. Conversely, as you move below market value, you attract a much larger percentage of potential buyers which typically shortens the time it will take to locate a buyer at that price. One of the important take aways from this illustration is that there is a range of market prices for every property. Take appraisals with a grain of salt. Appraisers don’t provide a price range; they must isolate a single market value based on a subjective series of adjustments to historical prices. The marketplace where investors compete represents all of the “bid” and “ask” prices of buyers and sellers in real time. That’s why you will see buyers in a seller’s market paying higher than appraisal. That’s also why you will see sellers in a buyer’s market selling for less than appraisal.

Appraisals are “lagging indicators” of value, not “leading indicators” of value. A lagging indicator confirms a previous price trend but it does not predict the future. A leading indicator helps you predict the future. When you hear someone say, “You should buy in such and such hot market because prices appreciated XYZ percent in the past year,” remember that person is describing a lagging indicator of value not a leading indicator. If you would like to see into the future of real estate, look for leading indicators of value not lagging indicators.

You will have an economic advantage if you know how to evaluate the leading indicators of real estate demand, supply, and one of the most overlooked real estate signals – affordability ratio. To learn more about using leading indicators to predict the future of real estate prices use this link to my blog article Predicting Real Estate Prices. If you enjoy the article, please leave a comment or question below.

While you can’t change the signals you are getting from the market, you CAN change your investment strategy depending on what signals you are getting. We are currently blessed with incredibly low long-term fixed interest rates. Low interest rates are a signal for how to invest. While current prices are high relative to rents, interest rates remain low. One of the best assets to acquire in this seller’s market is the ability to control long term fixed low interest rate debt and to use that debt to create positive cashflow now and in the future.

If you can borrower long term fix rate money at 4% and invest in a property or note that produces a profit of 6% or more, how much money would you like to borrow? As much as you possibly can!! This strategy is called arbitrage. Positive arbitrage means you are making money on the bank’s money. You can’t do anything about today’s high prices, but you can focus on winning through positive arbitrage. Over 30 years you will make more money paying a “seller’s market premium” for a property and financing it with today’s insanely low interest rates (4-5%), rather than buying cheaply at the bottom of a “buyer’s market” and financing it with traditionally historical interest rates (7-8%).

Here are two Hassle-Free ways to create positive arbitrage in today’s seller’s market.

Option one is for the long term investor (10 years or more) who is (a) targeting higher yields, (b) is willing to take on a little more risk to achieve higher yields, and (c) is looking for a blend of positive cashflow, tax benefits, equity build up, and shelter from inflation. The formula is simple: buy a rental property whose CAP rate is greater than the interest rate on the financing used to acquire the property. A good goal is to achieve at least a 2% spread between the long term fixed interest rate and the CAP rate. While you may be able to achieve a CAP rate to interest rate spread higher than 2%, you may not like the quality of property that comes with higher CAP rates. Hassle-Free Cashflow Investors gravitate towards newer properties that are lower hassle to manage and have lower risks associated with property maintenance. Watch this video series to learn more about this investing strategy.

Option two is for the income investor who is looking for a combination of safety, semi-liquidity, and immediate cashflow. The formula is to borrow money at a low rate to be a lender at a higher rate. You can borrow capital (aka equity stripping) at today’s long term fixed interest rates around 4-5% from a bank using equity in properties that you currently own. You then use the proceeds of the loan to buy income producing notes (aka hard money lending) secured by quality real estate in first position at conservative LTVs that produce interest income of 8% or higher. For example, if you borrowed $100,000 against your $125,000 free and clear rental property (80% LTV) and you make a $100,000 loan @ 10% secured in first position against a single family property valued at $133,333 (75% LTV) you would have two assets – a house and an income producing note – and you would have one liability – the mortgage on your $125,000 rental property. The income from the note @ 10% interest rate would produce $10,000 a year income and the cost of your rental property mortgage @ 4.5% interest rate would consume $4,500 of interest expense. You can create a $5,500 annual profit out of thin air just by moving $100,000 equity from an existing property into equity in an income producing note. Remember, you still own the rental property and the profit from the rental property is exactly the same. The profit comes from putting your equity to work in two places at the same time your equity controls the property and the note at the same time. Assuming the income producing note is in first position at 75% LTV, if the borrower stops paying you can foreclose on the asset and it’s like buying the property at a 25% discount. In fact, some hard money lenders prefer making loans to borrowers who are unlikely to repay the loan. They call it a “loan to own” investment strategy. Making hard money loans in a seller’s market is a great way to produce income and potentially acquire real estate at steep discounts you are unlikely to find in the currently competitive seller’s market.

If you are looking to accelerate your wealth through income producing notes, please email David@HasslefreeCashflowInvesting.com to receive access to our current inventory of income producing notes / private lending opportunities.

If you are looking to buy turnkey positive arbitrage rental properties, please click here to view our current inventory of hassle-free cashflow rental properties.

If you’d like help refining your personal investment philosophy, please click the link below to schedule a free consultation with professional investor David Campbell.