Ten Rules for a Hassle-Free 1031 Exchange

by Professional Investor David Campbell founder of www.HassleFreeCashflowInvesting.com

An Internal Revenue Code Section 1031 Tax Deferred Exchange (“1031 exchange”) is a tax and investing strategy that allows an investor to reinvest the profits from the sale of an investment property into another “like-kind” property while deferring the taxes owed on the sale. The goals of a 1031 exchange can include: increasing or decreasing management intensity, increasing or decreasing risk profile, and/or increasing or shifting (but not decreasing) leverage on your real estate portfolio.

Completing a 1031 exchange can be full of pitfalls even for the most experienced investors. It requires a combination of investing, financing, and tax strategies that frequently require the seamless coordination of multiple advisors, along with the adherence to strict timelines. Hopefully, this article will help you avoid the obvious, and some of the less obvious, pitfalls of doing a 1031 exchange. However, this article should not be considered a substitute for competent legal, tax, or investment advice.

- Ask yourself if you really need to sell the property. If you aren’t selling your investment property, you don’t need to a 1031 exchange! Selling a property involves a lot of transaction costs such as brokerage fees, title, escrow, buyer concessions, and property repairs. Doing a 1031 exchange means paying all of the costs of selling a property plus the added cost of buying a new property, paying a 1031 qualified intermediary, and professional tax preparation. It’s possible that doing a 1031 exchange is the best decision for you, but it’s an expensive proposition. Before listing your property for sale, it is important to explore less expensive options for getting the personal and financial benefits you are seeking without selling your property. It is a common mistake for novice investors to churn their property portfolio because it makes them feel like they are doing something of value when they might not be creating any measurable benefit from all that buying and selling. If your goal is to pull equity of a property, considering doing a cash-out refinance or taking a cash-out second mortgage. Even if the interest rate on the refinance is higher than your current rate, the higher interest expense and refinancing costs might still be less expensive than paying the transaction costs of a sale and 1031 exchange. You might find an opportunity to use the equity in your existing property as equity in a cross collateral loan to buy a new property. This cross-collateral financing strategy is likely only offered on commercial and/or privately funded loans. This is a strategy I have used many times when acquiring seller-financed or privately financed properties. If your goal is reducing management intensity, look for property management solutions. There are as many solutions as there are problems. Selling and doing a 1031 exchange is only one of an infinite number of solutions available to you; don’t rush into it!

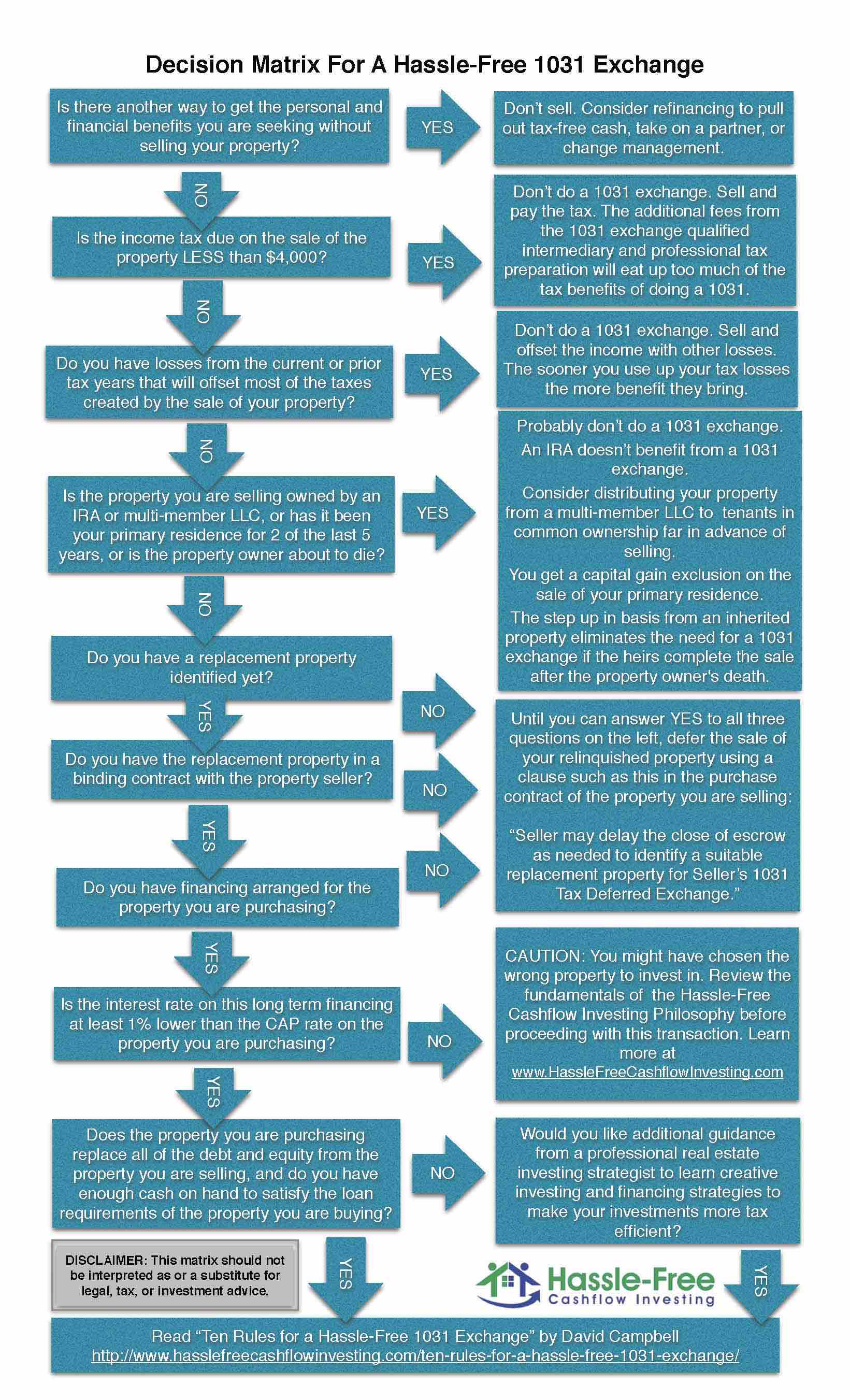

- Even after you’ve made the decision to sell, should you do an exchange or just realize the profit? Many investors assume that they should do a 1031 exchange on every property they sell. Ask your tax advisor if you can use losses from the current or previous tax years to offset the profit from the sale of your property. Ask your tax advisor if you will owe taxes because of “depreciation recapture”. It’s possible to buy and sell a property for the same price and still end up with a paper profit and taxable event because of depreciation recapture. One of the rules of doing a 1031 exchange is buying a “like-kind” property. There are specific IRS rules that define like kind. (For example: You probably can’t sell a rental house and 1031 exchange into a mortgage note, gold, stock, or LLC partnership interest. You probably can sell a rental house and 1031 exchange into a shopping center, vacant land or apartment building.) If you’re selling a profitable property and considering a 1031 exchange, it’s probably because prices are up and it’s a sellers market. When you are doing a 1031 exchange in a seller’s market, you are setting yourself up to be a buyer in a seller’s market. That’s less than optimum. It could make sense to realize your profit on highly appreciated property and then sit in cash until the next buyer’s market or to pay the tax and buy an asset type that is on sale (e.g. sell an appreciated property, pay the tax, and purchase gold or an income producing mortgage note). It could also make sense to sell highly appreciated property and 1031 exchange into property in a different geography or product type that produces superior cashflow. Be wary of falling into the trap of purchasing a bad investment through a 1031 exchange just to avoid income tax on a successful investment. Don’t let the tax tail wag the investment dog. Consult the Hassle-Free 1031 Exchange Decision Matrix below to help you decide whether a 1031 exchange makes dollars and sense for you.

- Know what you want to buy before you sell. What benefits does the new property bring that your current property does not? By selling one property and exchanging into another, you are saying that the benefits of the new property plus transaction costs will outweigh the benefits of the old property. When doing a 1031 exchange you must identify the replacement property in the exchange within 45 days days of selling and close escrow on the replacement property within 180 days of selling the relinquished property. Far too many investors don’t start looking for a replacement property until after their clock starts ticking with the IRS. The IRS rules for 1031 exchanges are very strict and there are no “do overs” if you don’t follow the IRS timeline to the letter. Before you even list your property for sale, make a list of the personal and financial benefits you are seeking from the exchange. Then with the help of a competent real estate investment advisor make a list of hypothetical properties that could fit your exchange size and investment criteria. In short, the time to decide what you want to buy is before you commit to the sale of your relinquished property.

- Make sure you have acquisition financing lined up before you sell your property. A successful 1031 exchange is one that results in no taxable event in the year of sale. One requirement of an exchange is that you replace all of the debt and equity from the relinquished property. A very common mistake is that an investor sells their relinquished property and then finds out after their 45 day identification period has expired that the property they identified doesn’t qualify for financing (e.g. non-warrantable condo or can’t get a clean title commitment), or the investor’s credit and income are insufficient to get the loan, or the investor doesn’t have enough cash on hand to satisfy the down payment requirements of their lender. It is common for an investor to have completed a cash out refinance on an appreciated property long before the date of sale, and when they later sell the property they have a huge paper profit but relatively small proceeds of sale. If you are selling an appreciated property and will net less than 25% of the sales price in cash, you may have a difficult time acquiring and financing a replacement property without injecting cash from outside the exchange or creating a taxable event by purchasing a property for a lower price than the property you sold. Make sure you know you have your financing strategy in place before the 45 day identification clock runs out!

- Get contractual control of the property you want to buy before you sell. I’ve had investors who naively let their identification period expire without having the contractual right to buy the properties they identified. Formally identifying a property to your qualified intermediary that simply looks nice on the internet is a recipe for 1031 disaster. Even if you’ve written a full price offer on the property it doesn’t mean you’ll successfully get the property in contract or to the closing table. Absolutely never let your 45 day identification period expire without having at least TWO suitable properties IN CONTRACT (see rule number 7 below). No exceptions! The time to set yourself up for success in the negotiation of your replacement property is when you are negotiating the sale of your relinquished property. Do everything you can to include a purchase contract clause in the sale of your relinquished property such as “Seller may delay the close of escrow as needed to identify a suitable replacement property for Seller’s 1031 Tax Deferred Exchange.” (Consult your legal advisor!) Then ideally you shouldn’t close escrow on your relinquished property (thus starting the 45 day identification period) until you have a suitable replacement property IN CONTRACT. Did I say “IN CONTRACT” enough times?!?! It’s that important.

- Have your due diligence and seller repair negotiations completed before the end of your 45 day identification period. If you let your 45 day identification period lapse and you haven’t finalized your physical inspections and repair negotiations with the seller, you can be sure that the seller will have the upper hand in your negotiations. Don’t forget to complete your review of the title commitment during your 45 day identification period. Most investors never look at or even ask to review the title commitment because they don’t know what it means or how it is relevant to their due diligence. You can be sure your lender will be looking at the title commitment and that could be difference of getting a loan and not getting one. The title commitment might also reveal a cloud on title that the seller might not be able to cure during your 180 day exchange period. It is rare to have a title issue that can’t be cleared in 180 days, but you don’t want the success of your exchange riding on something totally out of your control. You don’t want to find yourself having to choose between buying a rotten property or paying a huge tax bill for failing to buy the property you’ve identified.

- Identify a safety net property owned by a friendly party. There are multiple ways of calculating how many properties you can identify for your exchange. If you are planning correctly, you don’t have to buy all of the properties you identify. The rules for identifying more properties that you eventually purchase can be complex so be sure to get professional advice on this point as early as possible during your 45 identification period. Always identify the property you really want to exchange into plus at least one spare. Your spare property should be a safety net property owned by a friendly party as insurance against your first choice property falling apart. Even if you don’t want to own the safety net property long term, you can close escrow on your safety net property and immediately resell it allowing you to restart your 1031 exchange clock.

- Make a calendar with the critical dates of your 1031 exchange. This is a simple concept that is so rarely implemented. Your qualified intermediary will help you identify the critical dates your 45 day identification period and 180 day close of escrow requirement will expire. Be sure to communicate these dates to your broker, your lender, and the title company. If your title company and lender are notified at the last minute that you are intending to complete a 1031 exchange as part of the purchase of your replacement property it can cause significant delays which ironically could push your closing past a critical deadline and thus cause your 1031 exchange to fail. One of the keys to a Hassle-Free 1031 exchange is open communication and not waiting to do things at the last minute.

- Choose your 1031 exchange team wisely. 1031 Exchange Qualified Intermediaries (QI for short) are not required to be licensed, regulated, audited, or monitored by any regulatory body. Neither are they required to be bonded, insured or maintain any other form of minimum equity capitalization. Basically, pretty much anyone can start a 1031 Exchange Qualified Intermediary and begin administering 1031 exchange transactions. A low quality QI can cause your 1031 exchange to fail and you could be stuck with a huge income tax bill. Even worse your QI could lose or embezzle the capital they are supposed to be holding in trust for you. Your choice of QI is critically important to your success. Never pick your 1031 Exchange Qualified Intermediary solely based on their fees. Although I generally prefer spending my money at local small businesses, when it comes to hiring a qualified intermediary for your exchange you’ll want to choose a very large and well respected player in the QI industry. You will definitely want to hire a real estate broker and/or real estate investing strategist who has a lot of experience completing 1031 exchanges. The vast majority of residential real estate agents have never completed a 1031 exchange. You may need to expand your network outside of your local market to find an experienced broker who specializes in investment property to advise you in your 1031 exchange transaction. Our company would gladly offer you a referral to a strong investment broker and/or Qualified Intermediary.

- Download and read this free ebook “Guide to 1031 Exchanges”. In this free ebook you will learn: how to comply with the basic 1031 exchange rules, tax deferral and exclusion strategies, four types of exchange structures, the role of your Qualified Intermediary, and what a qualifying use property is. You can download your free copy CLICKING HERE.

If you are contemplating a 1031 exchange, the author of this article, David Campbell, would be happy to offer you a no-cost investment strategy phone consultation to see what insights he can bring to your unique situation. You may schedule your free consult by CLICKING HERE

The founder of Hassle-Free Cashflow Investing, David Campbell, started investing in real estate part-time while he was working as a full time high school band director with zero net worth. Within six years and before the age of 30, David had become a financially independent millionaire through the vehicle of part-time real estate investing. David left public school teaching in 2005 to focus on real estate development and commercial real estate investment brokerage. His company’s investing and advisory experience has included single-family houses, apartments, retail, office, medical, condo-conversion, net-leased properties, syndications, land development, production home building, private lending, and winery. David has been a featured guest on some of America’s top radio shows and investing podcasts. His blog www.HassleFreeCashflowInvesting.com has been repeatedly named one of the top 100 real estate blogs in America. David is widely recognized as a cashflow real estate investing expert with real estate transactional experience totaling in the hundreds of millions of dollars.

As an alternative to the 1031 exchange and all the associated costs, tasks, etc. take the Hassle Free road to real estate investing success by choosing notes.

Amazing Blog created by you.It is really informative and helpful for me.