We are living through interesting times. If you’re thinking about investing in real estate (or anything for that matter) in a Seller’s market, it’s essential to change your investing strategy to respond to different investment cycles.

Amateur investors learn an investing trick that worked once and try using that same trick over and over in all market cycles. That’s like planting corn in your garden every single month of the year. Some months you’ll have a bumper crop and other months you’ll wonder why there is no corn growing in your frost-covered garden. Your mutual fund sales person will call that dollar cost averaging; I call it silly.

There are times for buying and there are times for selling and times for just holding on. Having invested through the last real estate cycle of boom and bust and boom again, I am currently investing a lot more conservatively than I was in 2003-2007. Although real estate is local and there will always be good deals to be found, in today’s market good deals are definitely getting harder and harder to find. That’s because we are in a Seller’s market. In a Seller’s market, amateur investors overpay for properties because they don’t see any other alternative.

Investing 101 – buy as much as you can during a BUYER’S market. My home building company was very aggressive about purchasing heavily discounted vacant lots during the down market. Now that the housing market is booming, we are building houses with the help of contractors like Ideal Construction LLC and selling more houses than ever.

Vacant lot prices have quadrupled from the market bottom making it extraordinarily difficult to find vacant lots to replenish our inventory for future development.

Investing 202 – don’t overpay for assets during a SELLER’S market. Most home builders are currently ‘overpaying’ for the small supply of lots on the market, because they only know one trick – building houses. They have to pay the high market prices for lots because that is the raw ingredient that makes their business run. Many home builders will ‘overpay’ for lots even if that means their profit margins virtually disappear. Because they only know one trick, it means ‘overpay’ for their raw ingredient of lots or go out of business because they have no more lots to develop.

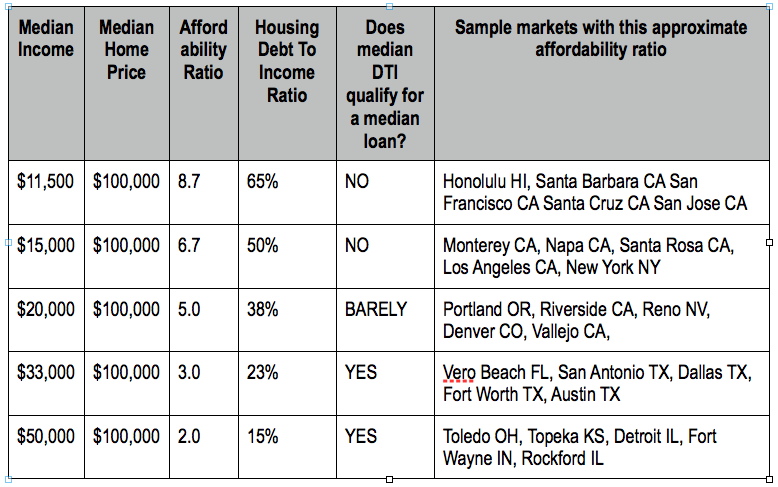

If you’re thinking about buying real estate in a Seller’s market, think long and hard about that decision. Although I don’t think we are at the peak of the current real estate or stock uptrend, I do think we are currently well above where the next market bottom will be for both real estate and stocks. Of course, if you’re buying real estate for long term cashflow and positive arbitrage, it could still make sense to buy today because interest rates are still incredibly low. You could say that real estate is in a Seller’s market, but interest rates are still in a Buyer’s market. If you are buying ‘over priced’ real estate with ‘under priced’ financing and you are positively arbitraged you hold on for a very long time, you’ll probably do very well. (Positive arbitrage is when your CAP rate exceeds your interest rate)

Investing 303 – When equities are overpriced, sell equities and buy bonds. In most of today’s US real estate markets, real estate is now overpriced. Click here to read my blog article “How To Predict Real Estate Prices” to determine whether your real estate market is currently under or over priced. DON’T MISS THIS PROFESSIONAL INVESTOR HINT: I am currently selling most of my real estate portfolio, using the cash to buy mortgage notes, and will sit on the sideline collecting mortgage interest until the equity market / home prices crash. I plan to buy back into the real estate market at the next cycle low. I am currently buying precious metals as their price continues to drop, as well as farmland and timberland as an ultra-conservative hedge against hyper-inflation and a potential currency collapse. Market cycles are very long. It can be a decade or more from market bottom to market top and back down again. Amateur investors do not think far enough into the future. They plant corn seeds in summer expecting to harvest their corn crop in the middle of winter. Sometimes it just makes common sense to stop planting and wait for the proper season for planting to come along.

Investing 404 – Not all bonds are created equal. Mortgage notes are my personal choice of bonds. The only thing I own in my IRA is mortgage notes. A mortgage note (bond) is a promise to pay secured by a piece of real estate. If the borrower pays me as agreed, I am happy because I have earned a 10% interest rate with no tenants, no toilets, and no vacancy. If my borrower pays late I earn late fees in addition to mortgage interest and my ROI goes even higher. If I buy a corporate or government bond and they don’t pay, I can pretty much write off that investment as a total loss. If I buy a real estate mortgage note (bond) and the borrower doesn’t pay as agreed, I will do the happy dance of joy because I get to foreclose upon the real estate for pennies on the dollar. By restricting my original loan amount to 75% of the property value, I should make a higher return on my money by foreclosing on the borrower’s equity rather than getting paid as agreed. That’s what I call a win-win! If the price of real estate drops and I have to foreclose, I at least have the borrower’s 25% down payment equity as protection from loss. I also have title insurance to help protect my investment from fraud and/or sloppy paperwork.

I am currently focused on buying income producing mortgage notes in Dallas, Fort Worth, and San Antonio Texas. These three cities have excellent population growth, economic diversity, very affordable and stable housing prices, and the foreclosure laws are extremely favorable to lenders. I’ve been buying and brokering mortgage notes in those cities for about five years and I’ve developed an extremely strong system in the process.

Using the strength of my investor network (the same network that brought you to be reading this blog post today), I have developed a steady supply of mortgage note investment opportunities. I promise you won’t find mortgage note investments like these anywhere else, because these notes are specifically created by my team to fit my personal investment philosophy.

All of our mortgage notes:

(1) are in the foreclosure friendly state of Texas and the rapidly growing markets of Dallas, Fort Worth, and San Antonio.

(2) are secured by recently renovated, highly affordable, single family homes in class B neighborhoods near major employment centers.

(3) have strong borrowers with less than 45% debt to income ratio.

(4) are 1st position deeds of trust at ~75% loan to value.

(5) have mortgage payment comparable to the cost of renting the same property. If it is the same monthly payment to rent or own, the borrower has little economic incentive to default. If you do foreclose on a non-performing note, you can resell the property for cash or rent out the foreclosed property and generate about the same net operating income as you were getting from your note.

(6) are supported by a conditional buy back guarantee from Hassle-Free Cashflow Investing giving our investors peace of mind and a secondary source of repayment for their mortgage investment.

(7) are professionally serviced by a licensed and bonded mortgage servicing company.

(8) are self-directed IRA friendly. Our team can handle all of the compliance paperwork for you.

(9) are turnkey and hassle-free.

(10) have lender title insurance in place issued by Chicago Title Company and paid for by the borrower.

(11) have zero investor closing costs associated with the purchase price.

(12) are able to be purchased at a nominal discount below the face value of the note – usually about 99 cents on the dollar and the 10% annualized ROI would be improved if the borrower paid their note off early.

(13) have complete due diligence files available on the property, the loan, and borrower.

(14) are professionally underwritten by a licensed and insured residential mortgage loan originator (RLMO) to be “Frank Dodd compliant”.

(15) are secured by houses who have a minimum value of $75,000.

(16) are fully amortized over 15 years but can be resold for the amount of the unpaid balance at any time.

(17) have a bite sized purchase price between $60,000 – $120,000

If you would like to purchase high-yielding real estate notes secured by 1st position deeds of trust recorded against quality real estate in Dallas-Fort Worth, TX send us an email – David@HassleFreeCashflowInvesting.com or call 866-931-9149 ext 1

To request general information about mortgage note investing, you can read my free white paper – “CLICK HERE for Secrets of Hassle-Free Cashflow Lending” as well as watch this video “CLICK HERE for Investing and Tax Strategies for Mortgage Note Investors” and this video “CLICK HERE for Nuts and Bolts of Being a Private Lender.”