Many of the local real estate markets in America are in a Seller’s market. If you want to determine if your real estate market of choice is a Buyer’s or Seller’s market CLICK HERE to read one of my most popular blog articles: “How to Predict Real Estate Prices”

I get this question a lot: “Should I Buy A Home In Today’s Seller’s Market?”

This is easy to answer from a purely theoretical perspective: NO!

- Buy during buyer’s markets.

- Sell during seller’s markets.

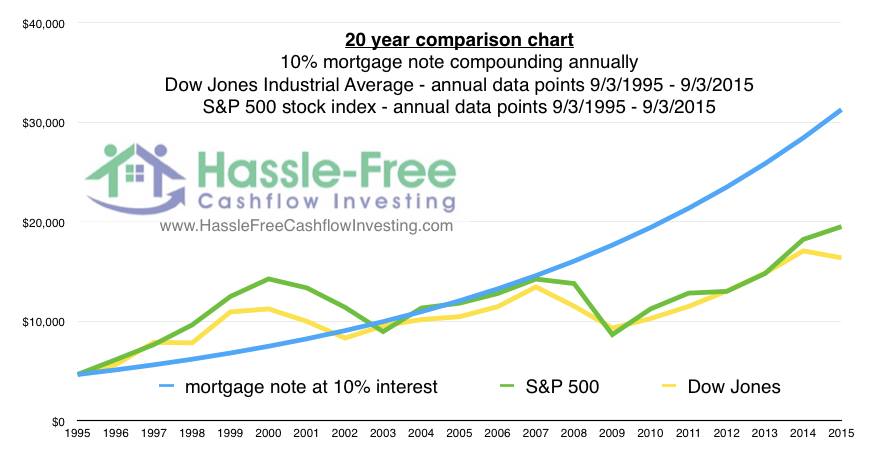

- In between market cycles have your money invested in well-secured income-producing bonds like mortgage notes.

(Disclosure: Yes, I sell mortgage notes and I hope you buy lots of mortgage notes from my company. However, I hope you can read past this author bias because there are a lot of good lessons to glean from this article. Shameless plug: CLICK HERE to gain access to our current inventory of Hassle-Free Cashflow Mortgage Notes producing 10% annualized ROI.)

When I look at the vast number of buyers in today’s real estate market, I want to shout “WHERE WERE YOU FIVE YEARS AGO?” when it was the best buyer’s market of our lifetimes. You see it always happens this way… Smart investors buy when everyone is selling. When everyone is buying, dumb money rushes in and smart money sells. I’m not saying don’t buy right now. I’m saying BE SMART about buying. If you can still borrow at 5% and buy a property producing a +6% return… well, that sounds pretty smart to me. You see, even though real estate prices are relatively high right now compared to rents, money is still cheap (as a result of an abundance of Federal government stimulus). Interest rates are low which means it is a buyer’s market of debt. Smart investors are still borrowing all the money they can get their hands on at long term fixed interest rates. What do you do with that cheap money after you borrow it… well, BE SMART and make sure you are “positively arbitraged”.

If you aren’t really, really, really sure what “positive arbitrage” means, you must absolutely watch this free video series as soon as you’re doing reading this article: CLICK HERE

After you’re done with the above video series watch this free video training series on real estate investing math.

CLICK HERE

These two sets of free investor training videos could make you rich, or at the very least they could save you from making some very poor financial decisions.

OK class… everyone turn to your neighbor on the right and explain “positive arbitrage”. Getting the positive arbitrage formula right (CAP > interest rate) is the razor’s edge difference between financial freedom and bankruptcy. Positive arbitrage is the most important real estate lesson there is. Unfortunately, very few people teach it. If you don’t understand positive arbitrage well enough to teach it, please promise you will watch the above videos and not just gloss over this point.

The question “Should I Buy A Home In Today’s Seller’s Market?” is harder to answer from an owner occupant perspective because a primary residence is both a consumable item for pleasure and utility as well as a major financial investment.

As long as it is cheaper to rent than own, you are financially ahead to be a renter and go buy rental property in parts of the US where it is cheaper to own than rent (CLUE: this is why so many California investors are currently buying rental houses in Texas). When real estate prices are at a market cycle low, it could make financial sense to buy a primary residence even if the cost to own is higher than rent if you choose to speculate that when real estate prices return to market cycle norms you will make a bunch of equity that would be significantly greater than the cash flow “losses” you experienced from paying more to own than rent. The caveat of this formula is that once the market cycle booms, you need to sell your house, reinvest the equity, and go back to renting. In lieu of selling and going back to renting, some savvy property owners choose to harvest their market equity gains through a cash out refinance and reinvest the capital elsewhere. That is an excellent strategy as long as you have the positive arbitrage formula right (CAP > interest rate).

Of course, many times the decision to buy a primary residence is made on emotions rather than finances alone and that’s OK too. Ultimately, the money you earn is designed to bring you the things you want when you want them. So, if you can afford a house and you really want to own it, then market economics be damned! A house to live in is really a liability (not an asset) anyway. If you like the convenience of paying retail prices to get what you want when you want it, then who cares what part of the market cycle we’re in. A retail buyer will buy something because they want it and can afford it and that’s OK! I pay retail prices for food all the time. I know it is cheaper eating at home than eating out, but eating at a fine restaurant can be really, really fun. Sometimes it’s OK to pay retail prices for stuff you want when you want it. Just make sure you know you’re doing it on purpose. Dumb money buys the things they want because they want them and then justifies the expense as an investment. Expenses are fine; just realize that expenses and investments are very different things.

If it is cheaper to rent than own and you’re trying to make a financially intelligent decision, go find a rental situation you are happy in and use your cash to invest where the numbers make sense. If it is cheaper to rent than own and the house you want to buy is relatively fungible (e.g. not a unique one of a kind property that comes on the market once in a generation) then I would wait until the next buyer’s market to buy a house to live in. When the next buyer’s market comes along, it will be obvious to you and every one else because the words “foreclosure” and “short sale” will be on the evening news like it was 2009-2011 all over again.

If you have assets in the stock market, I would apply similar advice to the above. IMHO stocks are in a bubble. A few months ago, I published a prognosis to my newsletter subscribers that the stock market was at a top and ready to crash. The DJIA was 18,100 when I made that announcement. As you know, the market is currently down significantly from that point. Two weeks ago, I published to my subscribers that there is a lot more downward movement coming in the stock market. Today’s DJIA closed at 16,384… that’s a ~10% decline from the market peak just a few months. After reading my prognosis, a few of my investor clients cashed out of the stock market (at the top) and used their cash to buy well secured mortgage notes paying 10% interest. These clients achieved an ROI well over 20% annualized relative to where they would have been if they had left their assets in the stock market. Protecting yourself from loss is almost as good as earning a profit.

Of course, no one knows for sure where the market is headed so use your own judgement where things are going and how to prepare accordingly. Personally, I’m selling real estate in areas where I see a price bubble and moving this equity into income producing mortgage notes, farmland, and silver bullion. I am also still bullish on the Dallas-Fort Worth metro for acquiring income-producing, positively-arbitraged rental houses. If you can still borrow money cheaply and you’re looking to build long term equity and tax shelter, I would not be afraid of taking a long term investment position in the DFW rental housing market (HINT: CAP > interest rate). If you’re looking for investment opportunities in income producing Hassle-Free Cashflow Mortgage Notes or Dallas-Fort Worth (DFW) rental property, I am here to help you. Always remember, I offer a free 30 minute investment strategy consultation over the phone to help you navigate the potentially turbulent economic waters ahead.

CLICK HERE to schedule your no-cost investment strategy consultation with professional investor David Campbell

CLICK HERE to schedule your no-cost investment strategy consultation with professional investor David Campbell

Best regards,

David Campbell

Real Estate Investing Strategist

866-931-9149 x1