As I write this article in November 2014, your stock market accounts are probably bubbling over with record high share prices. You may have a desire to re-allocate some of your net worth from the “dangerously high” and volatile “seller’s” stock market into tangible, cash-flowing, investment real estate. You may also feel slightly disappointed you can no longer find the once in lifetime buyer’s market deals that were available in 2010-2012. It seems easy to make money in real estate while prices are low and headed up, but sophisticated investors know there are opportunities to make money in real estate in ALL market cycles. When upward price momentum slows down (like now in 2014), it becomes extra important to surround yourself with a support team to help you maximize profits.

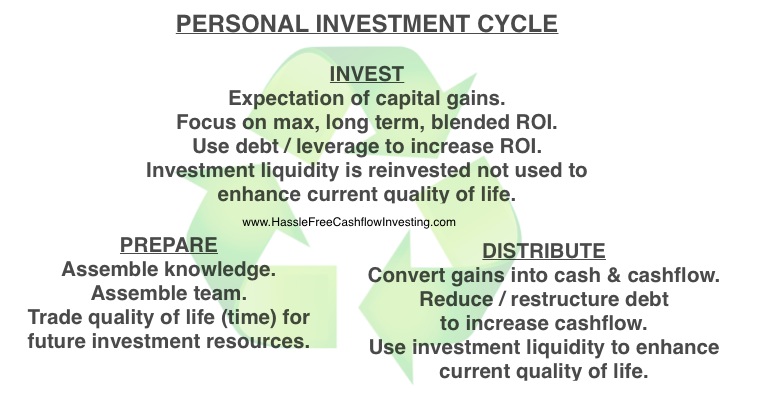

Investment Strategy #1: Become a Geographically Agnostic Investor. Real estate is local. If your local real estate market experienced a +50% increase in prices from 2010 to today (2014), it’s highly likely your local market is currently in a “transitional top market”. If your local real estate market is still affordable (median home price is less than four times the median annual income) and home ownership is cheaper than rent, it’s probable you are still in a buyer’s market. If you are willing to look outside of your local geography, you will always find a “buyer’s market” that is happy to accept your capital at the same time you are ready to buy. If you are stuck in the mindset of buying locally, you will inevitably find yourself ready to buy as a result of your “personal investment cycle” while your local geography is going through the “Seller’s Market” part of the “Market Investment Cycle”. Our company currently has access to turn-key, hassle-free cashflow rental properties in areas of the country that are still in a “buyer’s market” (good affordability and rents are higher than the cost to own). CLICK HERE to preview our current inventory of Hassle-Free Cashflow Investment properties.

Investment Strategy #2: Debt is currently in “buyer’s market” so get all the good, long term, fixed interest rate debt you can. Debt and real estate travel through market cycles at different times. Although real estate prices have come up, debt remains very inexpensive. “Good debt” is fixed interest rate debt that is used to purchase an asset whose income yield is higher than the cost of borrowing. Today you borrow at a low rate and invest at a higher rate (called positive arbitrage) while participating in very low risk investment activities. At other times in the financial market cycle, debt will be in a “seller’s market” which means interest rates will be high and to create positive arbitrage on your money you will need to chase aggressive (risky) investments to out earn the cost of borrowing. When you borrow money at a fixed interest rate and you lend out that money at a fixed interest rate, you have a predictable investment yield. Right now you can borrow to lend at a fixed arbitrage spread and acquire relatively low risk mortgage assets with the proceeds of your borrowing. If you borrow money out of your primary residence at the historically low fixed interest rate of 4% and you lend that money well secured by a first position mortgage lien on a property, you can earn the lucrative interest rate of 10%. Let’s see… if you Borrow at 4% FIXED and invest at 10% FIXED, the result is a 6% arbitrage spread. If you borrowed $100,000 at 4% at an interest cost of $4,000 per year and you loaned that money (well secured by a 1st position real estate lien) at 10% at an interest earning of $10,000 per year, your profit is $6,000 per year and your ROI is infinite because you are making a return on entirely borrowed capital. I will say this again because it bears repeating… debt is in a buyer’s market right now, so get all the good debt you can while long term fixed rates are low and then re-lend that capital at a predictable arbitrage spread for a relatively low-risk and highly lucrative cashflow investment. Give me a call 866-931-9149 ext. 1 or send an email to David@HasslefreeCashflowInvesting.com to gain access to our current inventory of Hassle-Free Cashflow Investment PRIVATE LENDING OPPORTUNITIES for mortgage income investors.

Investment Strategy #3: Chase The Buyer’s Market by Changing Asset Classes. When the stock market is high, consider buying gold and silver. Metals tend to go up in price when the stock market declines. Metals tend to go down in prices when the stock market goes up. When stocks are high, sell stocks and buy metals. When stocks are low, sell metals and buy stocks (if you invest in the stock market which I do not). Give me a call 866-931-9149 ext. 1 or send an email to David@HasslefreeCashflowInvesting.com if you would like more information on adding precious metals to your investment portfolio or self-directed IRA.