By: David Campbell, professional investor, developer, and founder of Hassle-free Cashflow Investing

Here are a few more reasons why I am absolutely certain Americans will experience high rates of inflation and how you can profit from it.

In my last newsletter, I said the Federal Reserve must inflate the price of real estate by 50% or banks will continue to fail in huge numbers. Why is this?

In areas such as California, Florida, and Nevada, radical fluctuations in home prices occurred between 2001-2010, causing prices to rapidly inflate and rapidly fall. This rapid swing in home prices left banks exposed.

A bank originating an $80 loan uses $10 of its own equity and it borrows an additional $70 to fund the loan. KEY POINT: Banks mostly loan out money that is borrowed from the Fed or created from thin air through the fractional reserve banking system.

Let’s look at a case study: In 2005, a borrower took out an $80 loan against a house worth $100. From 2005-2010, the price of the real estate dropped from $100 to $50 and in 2005 the borrower stops paying.

The bank CANNOT foreclose and resell the property, because the bank will not have enough money to repay the $70 it borrowed to fund the original loan. The lender can choose to take a loss on its $10 of equity, but if the lending bank defaults on the $70 it borrowed to make the loan, the bank is bankrupt and must close its doors. This is the reason over 300 American banks have closed their doors in the past 2 years.

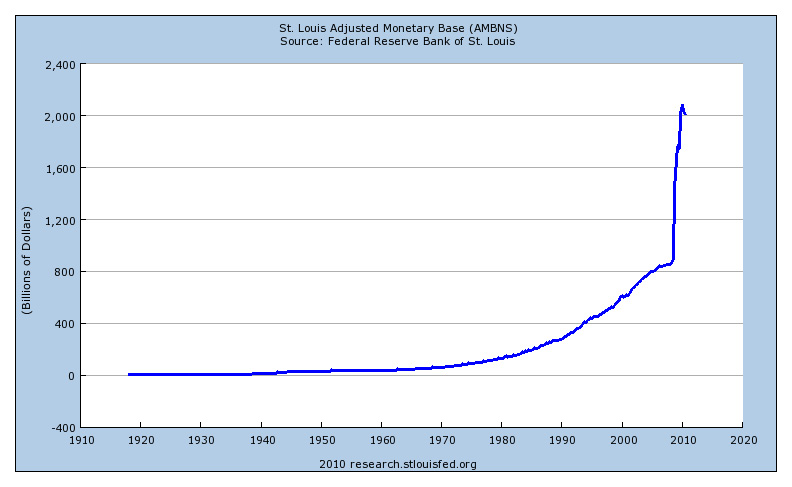

The value of real estate must increase (inflate) before the bank can clear the foreclosed asset off their balance sheets otherwise it will be forced to default on the money it borrowed to make the loans. If you hear about “shadow inventory” held by banks, it is foreclosed real estate that banks are unable to sell because it will trigger repayment of debt the bank cannot afford to repay. The US government is trying to save banks, by inflating real estate prices through a radical increase in the supply of money. The following chart published by the Federal Reserve may give you an idea of the staggering amount of money that is being created.

What is better for our economy, widespread bank failure or rapid inflation? The Federal Reserve has been explicit in its public commentary on this issue: aggressive inflation is preferable to continued bank failure. ‘Helicopter Ben Bernanke’ got his nickname by promising to jumpstart inflation by every means possible, even it if meant literally dropping cash from helicopters.

Inflation hasn’t hit the real estate sector yet, but it’s coming. The banking industry will stay in a nose dive and the Fed will keep printing money until real estate prices go up.

While the government publishes statistics about inflation in the form of the consumer price index (CPI), the CPI has a political agenda to radically underestimate true rates of inflation. Below is a chart from Casey Research that compares price changes of various commodities from Oct 2009 to Oct 2010. When core commodities like food and fuel increase 15-74% in a single year, you better pay attention to what’s going on.

Inflation moves in the following cycle:

1) increased money supply

2) increased commodity prices (food, energy, consumables)

3) increased manufacturing / wholesale prices

4) increased retail / consumer prices

5) increased wages

6) increased real estate prices

7) increased borrowing which further increases the money supply

This seven step cycle then repeats itself in perpetuity and the rate of inflation increases exponentially with the beginning of each new boom and bust cycle. Looking at today’s market data we are in between step three and four in the inflationary cycle.

Inflation is increased prices as a result of “printing money” or increased velocity of money. Change in velocity can impact inflation EQUALLY with the supply of currency. The effects of our rapidly increasing money supply are being temporarily masked by reduced velocity. Consumer confidence is low, unemployment is high, and people are hoarding cash. The result is moderate inflation. We will see radical inflation once the velocity of money ticks up.

Currency supply can increase to infinity, but velocity cannot reduce to zero. Reduced velocity is absorbing the majority of the increased currency supply, but this can’t go on forever. Look for signs that velocity is returning to the market and you will have a more accurate forecast of when inflation will enter the market.

A final, crucial point:

Knowing inflation is coming is very different than believing inflation is coming. The difference between knowing and believing is cognitive dissonance. People know driving without a seat belt is dangerous, but they do it anyway because they don’t believe the danger could happen to them. This is the way it is with inflation. A lot of smart people recognize the warning signs of pending inflation, but they are in disbelief that hyper inflation could happen to them – thereby erasing the value of their earnings, savings, retirement accounts, etc.

You can profit from inflation or become its victim! If you are like me and believe inflation is upon us, how will you prepare yourself for it? Doing nothing means your savings and wages will be decimated through increased consumer prices.

Acquiring Hassle-free Cashflow Real Estate is a very simple step towards prosperity and safety in the coming years. If you would like help building a successful real estate portfolio, please call me right away while prices are low, long term interest rates are low, and banks are still lending to qualified buyers. Inflation is coming, and this beautiful buyer’s market will not last forever.

Best regards,

David Campbell

Professional Investor / Developer / Financial Mentor

Founder of Hassle-Free Cash Flow Investing

707-373-9966

David@hasslefreecashflowinvesting.com