The Ultimate Tax SmackDown Event: Solo(k) versus IRA

The Ultimate Tax SmackDown Event: Solo(k) versus IRA

Would you like to maximize your retirement contributions as a Small Business Owner or Real Estate Investor?

Would you like to create tax free Roth money regardless of your income?

Would you like to invest in leveraged (financed) real estate inside your IRA and AVOID the hidden taxes UBIT and UDFI?

Would you like to access your retirement account TAX FREE & PENALTY FREE?

Would you like to recognize a retirement age younger than 59 1/2 without paying penalties to the IRS?

If you answered YES to any of these questions, you should consider the Solo(k) as an essential part of your tax planning strategy. The Solo(k) has some unique qualities that make it a more powerful tool than a traditional 401k or a self-directed IRA.

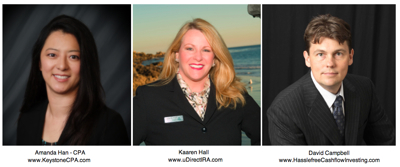

In this free training video for real estate investors and business owners, you’ll learn from world class faculty members: Professional investor David Campbell, self-directed IRA company president Kaaren Hall, and tax strategist Amanda Han, CPA who will help you learn:

* How the Solo(k) can be particularly helpful to real estate investors and business owners

* How a Solo(k) differs from other types of IRA accounts

* Who is eligible to own a Solo(k) and how to become eligible if you aren’t already

* How to get more money into your Solo(k)

* How to identify and use your eight essential resources to use your IRA or Solo(k) to legally earn more and pay less in taxes

* How to use financing and cash flowing real estate inside your IRA or Solo(k) to produce higher profits with less hassle and less tax

This video is appropriate for both new and well seasoned investors.

Keyword: solo(k)

Keyword: solo(k)