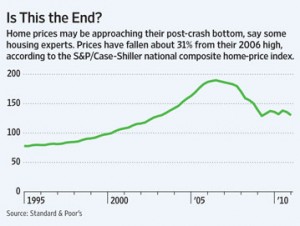

Why 2011 may be the end of the housing crash – excerpt from the Wall Street Journal

There might finally be some good news this year about the nation’s dismal housing market. Or, at least, the bad news could stop.

Either way, it will be welcome relief for current homeowners as well as for potential real-estate investors. Reasons to be optimistic have been sadly lacking since the housing bubble burst in 2006.

Housing Is A Good Deal

Housing is the most affordable it has been in decades, according to analysts at Moody’s Analytics. They don’t just look at house prices. They also look at incomes.

Nationally, the cost of a house is the equivalent of about 19 months of total pay for an average family, the lowest level in 35 years. Prices usually average close to two years’ pay, although that varies nationally.

Investors Stepping Up

Here’s another sign the market is nearing a bottom: Investors have started to buy up houses and condos, in some instances paying entirely in cash. That’s a far cry from the heady bubble days when borrowed money seemed the key to riches. The bubble-era speculators who got burned tended to buy at the peak and borrowed heavily to do so. When the crash came, they quickly saw their wealth erased.

Click here to read the complete article about the end of the housing crash in the Wall Street Journal.

Tags: Investment company, Investment education, Investment property, Real estate developer, Real estate education, Real estate investing, Real estate investment education, Real estate investment opportunities

Prices have dropped enough to make the investment cover the costs of holding it over the long haul.